2021 has been a year of significant regulatory and commercial delivery at Diurnal. The approval of Efmody in Europe represented a major accomplishment given that it represented the first approval of the company's flagship treatment for the rare genetic disorder congenital adrenal hyperplasia (CAH). Although the lack of orphan drug status may have made pricing and commercialisation plans more challenging, it is important to remember that EMA and CHMP provided Efmody with a broader label comprising not just adult but also adolescent CAH approval. Furthermore, with the availability of Alkindi for paediatric AI (including CAH), Diurnal can offer effective cortisol replacement therapy across the treatment continuum from infants through to adults.

Existing commercial infrastructure key

Launching a new pharmaceutical is inevitably a challenge and often takes longer than originally anticipated. In its favour, Diurnal has been able to establish a European commercial presence for Efmody through the rollout of Alkindi. While Alkindi sales have been modest, this is entirely in line with the size of the commercial opportunity. The important aspect here is that Diurnal now has access to key endocrinology centres throughout Europe for Efmody. Efmody represents a greater commercial opportunity, providing a replacement therapy that best mimics the normal physiological circadian release of cortisol. In particular, data from both the Phase 3 study and the extension study has shown that Efmody provides the potential for steroid-sparing in CAH patients, effectively managing excess androgen levels with physiological levels of cortisol. Encouragingly, we note the mention of these benefits in both the EMA and CHMP's reviews. This recognition is important as it suggests that Efmody may represent the only treatment required by many CAH patients.

Efmody has broader appeal outside of CAH

Efmody is also being evaluated for the larger adrenal insufficiency disorder, which is also characterised by low cortisol but without the complication of high androgens. Circadian delivery is also relevant here and represents a substantial market opportunity. Selling Efmody through the same salesforce should provide significant operating leverage. With the European Efmody experience, development risk for the same indications in the US should be reduced and allow a Phase 3 trial design that best capitalises on Efmody's benefits in CAH, with AI to follow. Diurnal has scheduled an R&D day for February 2022. We look forward, with keen anticipation, to more detail on the emerging endocrinology pipeline

Adrenal franchise in Europe primed for growth

For Diurnal, the transition from a development stage company to a commercial one changes its risk profile. For us, this is a positive with Diurnal in possession of two approved therapies in Europe and a valuable, highly targeted salesforce. Ultimately, retaining commercial rights will deliver the full margin to the company, and the promise of significant operating leverage as additional indications are approved (such as adrenal insufficiency). For some, it seems that the regulatory uncertainty of the failed primary endpoint in the Phase 3 trial has been replaced by the uncertainty of commercialising Efmody in the fragmented European market – particularly given its lack of orphan drug status.

However, it is important to remember that Efmody has been blessed with a broader label, including not just adult but also adolescent CAH, which provided a positive surprise (at least to us) on approval. Consequently, Diurnal's European endocrinology franchise comprises Alkindi - targeting children and adolescents with AI (including CAH), and Efmody - treating adolescents and adults with CAH. Together, Alkindi and Efmody allow Diurnal to provide a continuum of care throughout the CAH patient's life.

Notably, the existing infrastructure put in place to commercialise Alkindi is highly relevant to the commercialisation of Efmody. Diurnal's salesforce may be modest in size, but only a small number of key European endocrinology centres treat CAH patients. Therefore, the European sales infrastructure should be well prepared to expedite the awareness of Efmody to the relevant physician.

Although Alkindi's sales progress has been modest in Europe, it is important to note that recent progress has been highly creditable, with most newborns now receiving treatment with Alkindi. Ultimately, as a hydrocortisone preparation tailored for the paediatric AI market, Alkindi's commercial potential is limited. Indeed, Diurnal has previously noted that this is likely a $200m market opportunity.

Efmody, on the other hand, represents Diurnal's flagship therapy for disorders characterised by low cortisol levels. It has been well established that cortisol exerts its influence following a circadian rhythm. To illustrate the tight control over cortisol metabolism, studies have shown that, in individuals with a normal sleep pattern, cortisol levels rise between 2am and 4am, peak shortly after awakening, then decline during the day to low levels from around 6pm, before the cycle starts again. Perturbation of the circadian rhythm in those who do not have the benefit of a normal diurnal sleep pattern results in undesirable effects, including malaise, weight gain, and cardiovascular issues. While it has been recognised that the optimal solution would be to match the normal physiological release of cortisol, the general approach to date (prior to Efmody) has been to transition patients to long-acting glucocorticoids on reaching adulthood. These may permit less-frequent dosing and improved compliance but fail to address the issue of overnight androgens, which blights the lives of many CAH patients (particularly women).

It is clear that replacement therapy which does not follow a circadian release profile, is far from optimal in CAH, where management of overnight androgens (male hormones) is equally important to replacing lost cortisol. Unfortunately, the genetic mutation that results in no/low cortisol in CAH patients leads to a significant increase in male androgens as the body tries to make more cortisol but cannot. The accumulation of male androgens results in virilisation in females and fertility issues in both females and males. Control of this aspect of CAH requires high doses of glucocorticoids with the negative consequences of short stature, weight gain, and metabolic syndrome. Consequently, many CAH patients are dissatisfied with current therapy, are reluctant to medicate properly and therefore at risk of adrenal crises.

As a result, the principal goal of therapy in CAH is to provide control of overnight androgens at a low enough glucocorticoid dose to manage the symptoms of low cortisol and prevent adrenal crises. Diurnal's approach with Efmody has been to deliver hydrocortisone in an optimal manner that replicates the normal circadian rhythm. One of the key limitations of standard immediate release hydrocortisone therapy has been the inability to replicate the production of early morning cortisol required to prevent the overnight build-up of damaging androgens. The goal in pharmaceutical development in CAH has been to identify a treatment that reduces overnight androgens while at the same time providing sufficient cortisol to avoid a potentially life-threatening adrenal crisis. Data generated by Efmody in the Phase 3 study and the extension study suggest that this goal is indeed achievable for many patients with Efmody.

Post-approval, we have endeavoured to identify reasons to support our positive view on the prospects for Efmody. Looking at commentary from the regulators, we note that, for example, The EMA SPC highlights three benefits associated with Efmody. These include 1. Improved hormonal balance, which could be maintained in the longer term, 2. The potential to use lower doses of corticosteroid in some patients as well as 3."…. the ability to offer clinical value by allowing dosing that resembles the daily rhythm of natural cortisol secretion".

Of the benefits associated with Efmody treatment, we believe that the steroid-sparing aspect of Efmody therapy is particularly noteworthy. In the Phase 3 study, Efmody was associated with a 33% reduction in glucocorticoid dose, reducing the dose to cortisol replacement levels. Further endorsing these impressive data, the CHMP assessment of Efmody highlighted that at month 18 (interim readout in the extension study), patients had experienced a median reduction in total daily Efmody dose of 10mg (from 30 to 20mg) and that this "…represents a clinically meaningful steroid-sparing in these participants". A reduction in glucocorticoid dose to physiological levels should be sufficient, we believe, to satisfy the concerns of physicians, particularly given that using a lower dose could expose the patient to a higher risk of adrenal crises.

Given the clinical data, the unmet need, and EMA's supportive label, we anticipate strong support from CAH patient advocacy groups and endocrinologists treating the CAH patient. Indeed, the prospect of a more effective hydrocortisone preparation that better suits the needs of the CAH patient should lead to greater compliance. As we noted earlier, poor compliance has been a feature of high dose glucocorticoid use in CAH historically, leading to a higher risk of adrenal crisis. Importantly, the Phase 3 trial and the extension study confirmed a lower risk of adrenal crises in Efmody treated patients than standard GC therapy.

Despite already having the requisite commercial infrastructure, the roll out of Efmody requires successful reimbursement discussions on a country-by-country basis made more challenging by the lack of orphan drug status in Europe. Nevertheless, we believe that pricing discussions to date have been supportive, with Efmody now launched in key northern European markets of the UK and Germany as well as Austria.

Efmody androgen control with reduction in steriod dose

Source: Adapted from Merke et al., JCEM 2021

Additionally, we have previously highlighted the growing concerns from CAH patients regarding reduced fertility. This affects both men and women as a direct result of the production of excess androgens. Reassuringly, increased regulatory emphasis has been placed on the ability of treatment to reduce androgens and improve fertility rates in CAH patients. From Efmody's perspective, the data are both reassuring and encouraging. In the Phase 3 study, 4 patients resumed menses (compared to only 1 on IR hydrocortisone) with two partner pregnancies which achieved full-term delivery. In addition, one of the patients experienced an increase in sperm count while receiving Efmody. This trend continued into the extension phase of the study. Overall across both studies, 8 patients receiving Efmody resumed menses (only 1 on immediate release (IR) hydrocortisone) while 4 partners and 3 patients achieved pregnancy (0 on IR hydrocortisone).

In summary, we believe that the data to date are supportive of the role of Efmody as an important new treatment approach mimicking the circadian release of cortisol and better-controlling controlling overnight androgens. These include better control of the androgen precursor 17-OHP, improvements in fertility, and reduced adrenal crises. We also note that Efmody is not associated with a decrease in bone mineral density and offers better compliance. Importantly, this has also resulted in steroid-sparing with patients controlled on an Efmody dose required for adrenal insufficiency, which should satisfy the prevailing concerns held by endocrinologists regarding glucocorticoid overuse in these patients.

Europe and the UK remain the immediate concern for Diurnal as it seeks to prove the value of its smart hydrocortisone delivery. However, when it comes to commercialisation, Efmody should benefit from a ready pool of patients. Not only did Efmody benefit from a high retention rate in the extension study, but it is also important to note that such is the seriousness of CAH, identifying patients in this rare disease will not be a rate limiting step given that newborn screening has been introduced routinely in most developed countries.

Waiting for the US

Unlike Europe, the US promises the appeal of a homogeneous market where orphan drugs benefit from pricing power and more limited detailing resources. However, launching hospital-based products, particularly during the pandemic, has been a significant challenge, with access to physicians problematic. Nevertheless, the US has a vocal patient advocacy group, and with only circa 16,000 patients, we believe that CAH represents an attractive opportunity for self-commercialisation should Diurnal choose this option. We would be even more sanguine should Efmody benefit from orphan drug status and achieve a prescribing label supporting its potential to control androgens with physiological doses of hydrocortisone. It is also tempting to believe that, for an unmet need like CAH, Efmody should have a ready and willing audience with high KoL awareness driving physician uptake and reducing the commercial risk. Identifying adult patients may be more problematic in the US than in Europe. Patients can often get lost to treatment as they struggle to manage the competing challenges of hypercortisolism (from current treatments) and hyperandrogenism. We hope that introducing new treatments like Efmody (and the CRF1 inhibitors) should help resolve this reluctance to seek treatment which can be a feature of the US CAH patient population.

With a special protocol assessment (SPA) from FDA secured, details of the design of the US (and Japan) Phase 3 (CONnECT) study suggest that the outcome of the Phase 3 European trial has been helpful. CONnECT is a double-blind 52-week study with a biochemical responder analysis versus IR hydrocortisone in a non-inferiority design as the primary endpoint. Secondary endpoints should also provide important information comparing Efmody with IR hydrocortisone with respect to key measures, including steroid-sparing, fertility, body weight and quality of life.

CONnECT study schema

Source: Company Reports

The future is looking brighter for the CAH patient

The effort to improve the lives of patients with CAH has gathered pace recently. Not only has Efmody offered the potential for more effective control, the CRF1 inhibitors crinecerfont and tildacerfont have also found new roles in the fight to reduce the blight of overnight androgens. Targeting CRF1 should reduce overnight androgen accumulation, facilitating normal physiological dosing of glucocorticoids to prevent adrenal crises. Effectively, the expectation is that eliminating the high androgen concern reduces treatment to that of adrenal insufficiency. If successful, such an approach could also reduce the need for laboratory testing with an improvement in fertility (reduction in TARTs).

Interestingly, the approach followed by Spruce with tildacerfont is materially different from that of Neurocrine with crinecerfont and Diurnal with Efmody. Spruce has divided the CAH patient population into those who are poorly controlled or well controlled. Those who are well controlled are receiving high doses of glucocorticoid, while those who are poorly controlled are receiving sub-optimal dosing and likely cannot tolerate supraphysiologic doses. We suspect that this reflects the heterogeneity of the disease, recognising that it is a personal choice whether to accept the long-term consequences of high androgens or high glucocorticoids. As a result, tildacerfont is progressing through steroid-sparing as well as glucocorticoid reducing Phase 2b studies.

We believe that all of this activity suggests that the CAH patient may face the enviable prospect of multiple therapeutic options in future, potentially transforming treatment in a way that could not have been envisaged only a few years ago. However, we have previously highlighted our disappointment that none of the Phase 3 programmes underway (tildacerfont and crinecerfont) or planned (Efmody US Phase 3) have sought to evaluate the combination of CRF1 inhibition with optimised glucocorticoid treatment.

Intuitively, the combination of a treatment that reduces overnight androgens alone (CRF1 inhibition) along with Efmody, which best mimics the circadian release of cortisol, suggests that such a combination could represent optimal treatment for most CAH patients. Impressively, the data so far suggests that in many patients, Efmody alone may be sufficient in controlling overnight androgen production as well as the risk of adrenal crises. At the same time, however, we recognise that the lower the dose of glucocorticoid administered chronically has to be beneficial, suggesting a role for both approaches.

AI indication to deliver more operating leverage

While the focus for investors has been on the commercial prospects for Efmody in CAH, circadian delivery of cortisol should also apply to the more significant adrenal insufficiency (AI) disorder. AI is a substantially greater market with circa 300K patients in Europe and circa 155K in the US. As such, AI represents another orphan opportunity for Efmody in the US.

AI represents a more straightforward proposition for Efmody. However, arguably the unmet need is not so great compared with the CAH patient who has the added complication of high levels of male androgens requiring very high GC doses to control.

The objective here is clearer, delivering physiological doses of hydrocortisone to prevent adrenal crises, and is much more akin to a typical replacement therapy approach. Indeed, the value-added from an Efmody perspective is delivering cortisol in a circadian manner replicating the body's natural process and, in particular, high levels on awakening. Unfortunately, despite significant efforts to provide near to physiological dosing with existing glucocorticoid preparations, patients with AI still suffer from periods of hypo and hypercortisolism. Hypocortisolism runs the risk of adrenal crises, while hypercortisolism can also result in fatigue, low libido, and cognitive issues. Moreover, there remains significant inter and intrapatient variability with no easy diagnostic means of ensuring that patients are adequately controlled.

The treatment of AI is currently served by immediate release glucocorticoids and the modified release preparation Plenadren in Europe. There are no competing modified-release alternatives in the US, and we look forward to the US AI programme progressing after the Phase 2b CAH trial is completed.

As Diurnal seeks to position Efmody in the AI indication optimally, it has revealed the design of the Phase 2 CHAMPAIN study. This registration study assesses the ability of Efmody to deliver higher concentrations of cortisol versus Plenadren in the morning (primary endpoint). Secondary endpoints include the fatigue and quality of life measures, as well as looking at the response to therapy with respect to cortisol levels in the morning reaching a predefined level (>140 nmol/l).

Despite both endeavouring to provide more appropriate cortisol release than standard immediate release hydrocortisone, Efmody and Plenadren use different approaches with different results. Efmody offers delayed and sustained release of hydrocortisone, and as we have seen in the clinic, Efmody is effective at controlling overnight androgens. Plenadren, on the other hand, offers an immediate release outer layer and an extended-release inner core from its once-daily dosing. Its release profile approximates (rather than mimics) the physiological release profile of cortisol, providing adequate daytime control but less so overnight control of androgens. Consequently, we believe there is a good prospect of Efmody delivering a positive superiority result versus Plenadren from CHAMPAIN.

Operationally, the continuing roll out of the adrenal franchise should drive operating leverage with Efmody firstly in CAH and then in AI, sold through a similarly sized sales force throughout Europe. Developing Efmody for the US AI market will require a separate pivotal study.

Risks

The principal risks associated with Diurnal are primarily clinical and commercial. Clinical trials of novel drugs can be associated with risk of failure as well as delays, and we note that the COVID-19 pandemic has resulted in enrolment delays in clinical trials in general.

Diurnal has retained European rights to its adrenal disorder franchise, bringing commercialisation risks. The pace of uptake is difficult to predict, which could affect our forecasts, although we recognise that market expectations for Alkindi are modest. Following Efmody's launch in Europe, we expect that Diurnal will benefit from the existing sales platform, with only incremental costs required to secure a successful launch.

Diurnal is seeking to launch its products into what is primarily a generic market environment. Accordingly, we have assumed a price for Efmody that is consistent with the European price of Plenadren, a once-daily formulation of hydrocortisone, which looks to be a reasonable proxy. We note that there is no equivalent product in the US in this regard and have assumed that Efmody is priced at a premium. With Diurnal also now retaining US rights, we look forward to the company securing a price which reflects its orphan designation.

With Diurnal looking to partner several of its products in the US, including DITEST, there is an associated partnering risk.

As a development stage company, Diurnal is currently a loss-making enterprise. However, Diurnal has successfully raised funds to continue with its pipeline development ambitions and support the launch of Alkindi and Efmody in Europe.

Financial Model and Summary – not long to wait

As a commercial-stage company in Europe, all eyes are on the roll out of Efmody, Diurnal's flagship hydrocortisone preparation. For those who have followed its path to approval, development has been relatively tortuous following a missed Phase 3 primary endpoint. Nevertheless, Diurnal's efforts to ensure that the totality of the data and benefits were fully appreciated resulted in its ultimate approval for adult as well as for adolescent CAH patients.

We suspect that there are lingering concerns regarding self-marketing Efmody, particularly given the modest sales generated by Alkindi to date. However, this would be missing the point. Alkindi provides an oral sprinkle to replace the inaccurate crushing or compounding hydrocortisone for children. This compounding approach leads to variability in dosing. Efmody, on the other hand, provides significantly greater benefit delivering hydrocortisone in a way that mimics the body's normal circadian release and facilitates steroid sparing. Reducing the need for supraphysiologic glucocorticoid doses (while managing androgens) in CAH patients represents a significant unmet need. Ultimately, it is a product that provides a greater benefit than traditional hydrocortisone preparations (like Alkindi). Longer-term, the Phase 2 registration trial comparing Efmody to once-daily Plenadren should not only lead to optimal positioning in the larger AI indication, but it should also deliver clear superiority for Efmody's hydrocortisone delivery in general. These data, if supportive, should also dispel any lingering concerns following the lack of orphan drug status.

Anyway, so far, so good. The launch phase has been encouraging, with important markets including the UK and Germany as well as Austria providing reassuring feedback with respect to pricing. Despite the usual prolonged reimbursement negotiations, Europe should offer a helpful environment for the launch of Efmody with a limited number of key endocrinology centres, which should be familiar to Diurnal from the launch of Alkindi.

The US is an important market for Diurnal, not just for Efmody but also for its endocrinology ambitions generally. Ultimately, with the efforts of Diurnal and others, treatment of CAH in the US could be transformed if Efmody and therapies such as tildacerfont and crinecerfont are approved. Given that there is substantial evidence that glucocorticoid delivery should best mimic the normal circadian rhythm, and Efmody also has shown potential for glucocorticoid sparing, Efmody should become a well-established component of standard of care for CAH treatment.

Diurnal is now well funded, allowing the company to roll out Efmody in Europe and the UK, and advance its development in the US for CAH, and in Europe for AI. Additionally, largely behind the scenes, the broader endocrinology pipeline has progressed during the year with a streamlined and truncated development pathway secured for DITEST. We look forward to further details being revealed at the R&D day scheduled for 2nd February 2022.

Finally, as Diurnal seeks to fully exploit its Efmody franchise in the US, a Phase 2 study in AI could begin as early as 2023. This is an attractive market opportunity where Efmody also has orphan drug designation. AI represents a purer cortisol replacement opportunity with no overnight androgens to worry about, so no supraphysiological glucocorticoid dosing (or CRF1 inhibitors) required. The combination of CAH and AI suggests a total market opportunity of $3bn compared to our peak sales forecast of £700m.

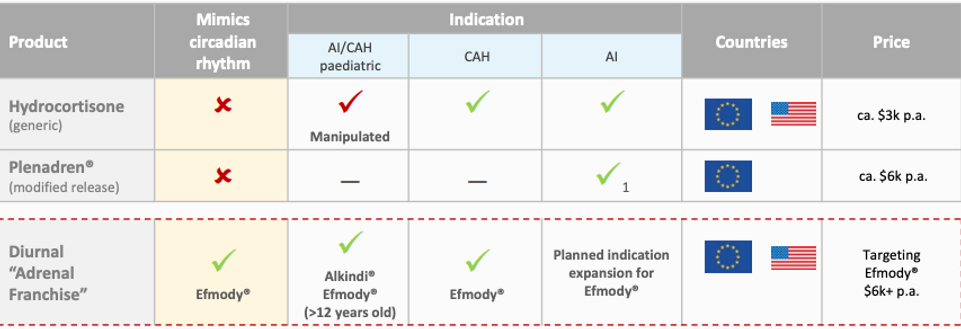

Competitive Landscape

Source: Company Reports

These are exciting times for Diurnal. It now has two licensed products in Europe, which should serve the continuum of adrenal insufficiency, particularly for CAH patients. Plans for the US are now in place, and we look forward to Efmody delivering on its promise in CAH as well as the broader AI indication. The company has the wherewithal to progress DITEST, and the pipeline behind is beginning to emerge, highlighting management's ambition to create a broad endocrinology franchise.

Adrenal Franchise Sales (£m)

Source: Calvine Partners Research

Diurnal Group Income Statement (£m)

Source: Calvine Partners Research

Diurnal Group Cash Flow Statement (£m)

Source: Calvine Partners Research

Diurnal Group Balance Sheet (£m)

Source: Calvine Partners Research

Disclosures

Calvine Partners LLP is authorised and regulated by the Financial Conduct Authority for UK investment advisory and arranging activities.

This publication has been commissioned and paid for by Diurnal Group and, as defined by the FCA, is non-independent research. This report is considered to be a marketing communication under FCA Rules, and it has not been prepared under the laws and requirements established to promote the independence of investment research and it is not subject to any prohibition on dealing ahead of the dissemination of investment research. The information provided is widely available to the public.

This report in the United Kingdom is directed at investment professionals, certified high net worth individuals, high net worth entities, self-certified sophisticated investors, eligible counterparties as defined by Financial Services and Markets Act 2000 (Financial Promotion) Order 2000. The report may also be distributed and made available to persons to whom Calvine Partners is lawfully permitted. This publication is not intended for use by any individual or entity in any jurisdiction or country where that use would breach law or regulations, or which would subject Calvine Partners or its affiliates to any registration requirement within such jurisdiction or country.

Calvine Partners may provide, or seek to provide, services to other companies mentioned in this report. Partners, employees, or related parties thereof may hold positions in the companies mentioned in the report subject to Calvine Partners’ personal account dealing rules.

Calvine Partners has only used publicly available information believed to be reliable at the time of this publication and made best efforts to ensure that the facts and opinions stated are fair, accurate, timely and complete at the publication date. However, Calvine Partners provides no guarantee concerning the accuracy or completeness of the report or the information or opinions within. This publication is not intended to be an investment recommendation, personal or otherwise, and it is not intended to be advice and should not be treated in any way as such. Any valuation estimates, such as those derived from a discounted cash flow, price multiple, or peer group comparison, do not represent estimates or forecasts of a future company share price. In no circumstances should the report be relied on or acted upon by non-qualified individuals. Personal or otherwise, it is not intended to be advice and should not be relied on in any way as such.

Forward-looking statements, information, estimates and assumptions contained in this report are not yet known, and uncertainties may cause the actual results, performance or achievements to be significantly different from expectations.

This report does not constitute an offer, invitation or inducement to engage in a purchase or sale of any securities in the companies mention. The information provided is for educational purposes only and this publication should not be relied upon when making any investment decision or entering any commercial contract. Past performance of any security mentioned is not a reliable indicator of future results and readers should seek appropriate, independent advice before acting on any of the information contained herein. This report should not be considered as investment advice, and Calvine Partners will not be liable for any losses, costs or damages arising from the use of this report. The information provided in this report should not be considered in any circumstances as personalised advice.

Calvine Partners LLP, its affiliates, officers or employees, do not accept any liability or responsibility with regard to the information in this publication. None of the information or opinions in this publication has been independently verified. Information and opinions are subject to change after the publication of this report, possibly rendering them inaccurate and/or incomplete.

Any unauthorised copying, alteration, distribution, transmission, performance, or display of this report, is prohibited.