Basilea Pharmaceutica

Derazantinib -the overlooked FGFR inhibitor

Dr Brian White

Andrew Keith

21 December 2020

With the anti-infectives franchise well understood, we believe that the emerging oncology franchise at Basilea has been overlooked. We concede that derazantinib’s competition has gained significant lead time advantage in the two lead indications of biliary (iCCA) and bladder (urothelial) cancer. Additionally, numerous FGFR inhibitors are competing for space in what appears to be a congested class. Fortunately, the market potential for effective therapies targeting FGFR is large. It involves most difficult to treat cancers and, to look on the bright side, the class itself has been validated. However, this would be missing the point. Although derazantinib has significant potential in FGFR driven tumours in monotherapy, we believe its potential to boost the activity of immunotherapy has been missed. Derazantinib appears highly differentiated with potent activity against the CSF-1/CSF1R pathway compared to its late stage peers, and this pathway is responsible for effectively blunting the effectiveness of the checkpoint inhibitors (CKIs). If successful, derazantinib could be a leader rather than a fast follower. Basilea has two trials ongoing to test this theory in combination with Tecentriq.

Pipeline potential

Basilea has invested heavily in progressing the development of its oncology franchise with derazantinib now a late-stage development candidate and lisavanbulin progressing. We have suggested that much now depends on Basilea's ability to prove that the additional capability of derazantinib to inhibit the CSF-1/CSF1R pathway can augment the checkpoint inhibitor class. We believe that there are reasons to be encouraged given that the CSF1R inhibitor class has been validated with the approval of Turalio. Importantly, although this remains a novel class the potential to combine with CKIs is ongoing with emerging data providing support and manageable toxicities. Adding coverage of another pathway could provide relief from tumour escape mechanisms and emerging resistance. We believe that the addition of an FGFR inhibitor like derazantinib can only be helpful in this regard.

Derazantinib could be best-in-class

Data from the Phase 1b PoC study, as well as the ongoing FIDES-01 trial, have been supportive. We anticipate topline 12-month data in iCCA in the near term and patients with FGFR2 fusions from FIDES-01. However, with the competitive noise, we suspect it will be the interim result of FIDES-02 in 2021, evaluating the CKI combination in urothelial cancer, which will drive appreciation of derazantinib's broader potential. Should these data prove positive, there will be greater expectations for the combination in the larger and more needy gastric cancer setting. (For Risks see Page 19).

Derazantinib – differentiated or fast follower?

We believe that derazantinib represents a differentiated participant in the now clinically validated FGFR inhibitor (FGFRi) class of targeted anti-cancer agents. Its early history, subsequent to the in-licensing from Arqule, has been a fast-to-market approach in its lead indication of biliary cancer (iCCA). Positive interim data already reported in a modest number of patients allows us to look forward to the near-term topline data. A positive outcome here, with a competitive profile, should allow derazantinib to compete initially in a modest market opportunity. Derazantinib is a fast follower in this indication following the approval of Incyte's Pemazyre (pemigatinib) in April 2020.

A significant market opportunity

Fibroblast growth factors, along with their receptors (FGFR1-4), are implicated in key aspects of cell regulation including proliferation, differentiation, migration and survival through interaction with multiple signal transduction pathways (MAPK, Pi3K, PLC and STAT). FGFRs are not constitutively activated normally, their activity being reserved for different cell types to deliver their preordained role in human development. Consequently, their dysfunction and/or untimely activation has been implicated in a broad range of cancers, which include most of the challenging cancers such as bladder, biliary, gastric, breast, ovarian and endometrial cancers.

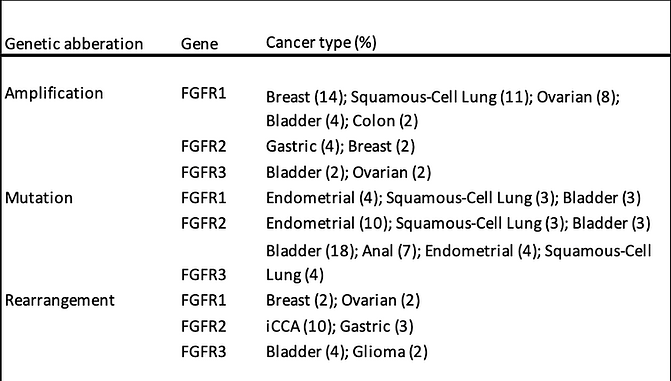

The activation of FGFR signalling can be attributed to several processes which include fusion, amplification or mutations (including missense mutations) in the coding region, as well as upregulation of the ligands and dysregulation of the non-coding regions.

Source: Company reports

FGFR mutations by tumour type

Source: Company data, Foundation Medicine Insights database (2019)

While the relevance of FGFR to various cancers has been recognised for some time, coverage of the FGFR receptor was initially provided by non-selective pan-RTK treatments such as Votrient (pazopanib), Lenvima (lenvatinib), Stivarga (regorafenib) and Inclusig (ponatinib). It Is clear, however, that these non-specific therapies may have provided adequate coverage of VEGFR, but poor coverage of FGFR.

This has been amply demonstrated, we believe, by an examination of the side effect profile which looks very different to that of the specific FGFR inhibitors (no hyperphosphataemia for example). Dovitinib is perhaps a good example of a pan-RTK inhibitor which although possessing activity against FGFR1-3, also exhibited activity towards VEGFR1-3, PDGFR-B, FLT-3, KIT, RET, and CSF1R. Formerly, a widely touted treatment for renal cancer with originator Novartis, lacklustre results led to its demise, although Oncology Ventures has apparently identified a more targeted patient population for this candidate. One of the main challenges with this pan-tyrosine kinase inhibitor (TKI) approach has been the observed toxicity which is likely associated with VEGFR inhibition.

The exponential increase in knowledge associated with the inhibition of the FGF pathway can be directly linked to the recent clinical development of more selective (and less toxic) FGFR inhibitors. In general, this heightened activity has been beneficial to the extent that these are targeted therapies and along with approved companion diagnostic tests, provide alternatives to the current crop of cytotoxics which suffer from significant side effects as well as resistance issue. Further, we believe that there has been a concerted move in oncology to treat only patients who are most likely to benefit from a particular therapeutic intervention. As a result, the introduction of targeted therapies generally has met with considerable support from regulators and clinicians alike.

Given that the FGF/FGFR signalling pathway has been involved in tumourigenesis and progression in many human cancers, it is perhaps unsurprising that this is a fiercely contested field. Many relevant tumours include multiple myeloma, as well as gastric, breast, bladder, prostate, and endometrial cancers. Mechanisms for genetic alteration of the FGFR pathway include gene amplification, mutations, gene fusions, or receptor overexpression. This deeper understanding of FGFR driven cancers at the molecular level has led to a very focussed development effort for those product candidates that populate the FGFR inhibitor class.

With FGFR involvement in tumour biology well established, efforts are ongoing to determine which of the receptor tyrosine kinases (RTKs) are involved in particular cancers. One direct method is to sequence tumour samples and to determine which RTKs are involved and what type of mutation is driving the process. Looking at derazantinib as an inhibitor of FGFR1-3, activating mutations in FGFR2 occur in circa 12% to 14% of endometrial cancers, and have been observed to occur in a small proportion of squamous NSCLCs, gastric, and urothelial cancers. FGFR2 translocations/fusions are found in circa 12-16% of intrahepatic cholangiocarcinomas (iCCA) and occasionally in lung, thyroid, and prostate cancer. Activating mutations in FGFR3 are particularly prevalent in urothelial cancers, occurring in up to 80% of non-muscle invasive urothelial cell carcinomas and 20% of high-grade invasive urothelial cancers. Activating mutations in FGFR1 and FGFR4 are relatively uncommon.

We have established that Basilea is operating in a relatively new field but one which has been validated by the wealth of clinical data (in-house and elsewhere) and the approvals of Pemazyre (biliary cancer) and Balversa (urothelial cancer). Importantly, both Pemazyre and Balversa received accelerated approval reflecting the unmet medical need.

While it is inevitable that the 35.5% ORR seen with Pemazyre has overshadowed derazantinib's observed 21%, we would caution that cross-trial comparisons of single-arm studies have significant limitations, including confounding factors. Additionally, we have yet to see the full readout from the ongoing FIDES-01 study. Nevertheless, we view the approval of pemigatinib as a major de-risking event for the FGFR inhibitor class in the iCCA setting.

Additionally, even a cursory look will show that there are numerous FGFR inhibitors in development, making it difficult to ascertain how successful each will be and the positioning of one compared to another. Clearly, this will change over time as new data emerges and inevitably some programmes will fall by the wayside.

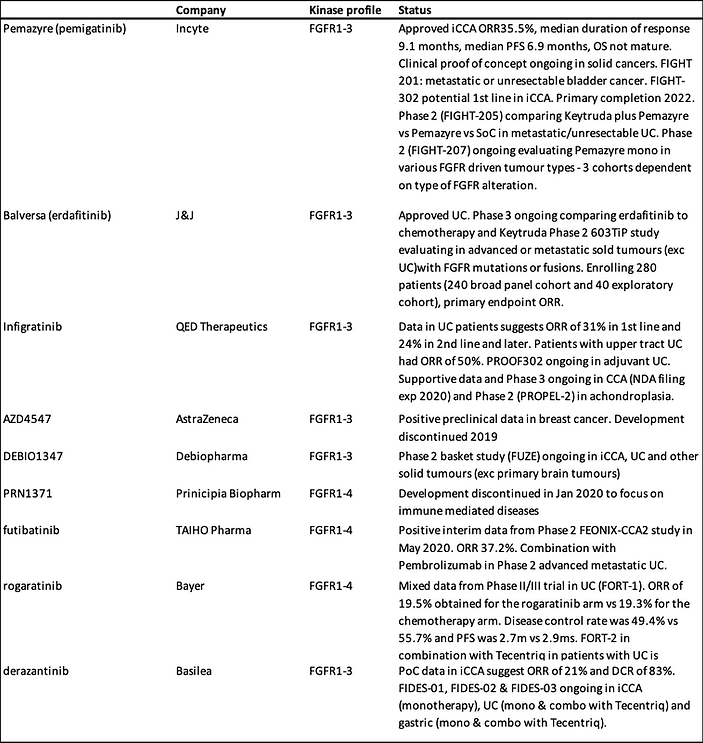

At face value, derazantinib looks like a fast follower, however this would be missing the very different specificities and characteristics of each product, making cross-trial comparisons particularly challenging. In the following table we have summarised the various FGFR inhibitors and their properties. Many FGFR inhibitors target several of the FGFR receptors, usually 1-3, or in the case of rogaratinib, 1-4. Derazantinib on the other hand, is a targeted inhibitor of FGFR1-3. The side effect profile of these targeted therapies looks to be well tolerated with hyperphosphataemia in particular, a class effect and one associated with FGFR inhibition. From a drug development perspective, most inhibitors have avoided FGFR4 which has been associated with some toxicity.

To be fair, therapies targeting the FGFR class have been associated with manageable toxicities. The most frequent adverse events reflect the mechanism of action and several of these, including hyperphosphataemia, fatigue, diarrhoea and nail toxicity, are considered to be class effects. While we suspect it is unlikely that commercial success will be determined by nuances in the AE profile of different FGFRis given the shared mechanisms, we note that derazantinib does appear to have a more favourable profile than erdafitinib with lower levels of drug-related retinopathy, stomatitis, hand-foot-syndrome or nail toxicity.

FGFR inhibitors in development

Source: Calvine Partners Research

Circa 15% of iCCA tumours are caused by FGFR2 fusions and previous preclinical studies suggest that only tumour cells harbouring gene fusions respond to FGFR inhibitors. Hence the initial focus for many FGFRi programmes and derazantinib has been targeting iCCA patients with FGFR2 gene fusions.

Data presented to date with derazantinib has provided significant comfort regarding the fast to market iCCA indication. While iCCA is a modest indication with respect to patient numbers - 3% of all GI tumours, it should be remembered that prior to the approval of the first targeted FGFR inhibitor (pemigatinib), the median survival was less than 2 years for those patients for whom the tumour was unresectable. On the other hand, iCCA patients with resectable tumours can look forward to a 5-year survival of over 60%. For those with advanced disease (the vast majority of patients at diagnosis), gemcitabine/cisplatin has been 1st line treatment. However, OS with the combination is only 11.7 months.

FDA approval of Pemazyre for iCCA was for patients who had received at least one previous chemotherapy and who had a confirmed FGFR2 mutation. Approval benefited from Breakthrough Therapy Designation and Priority Review, reflecting the unmet medical need. While great care needs to be taken with respect to cross-trial comparison, we note that the ORR in the treated patient group was 36%. Among the 38 patients who had a response, 24 patients (63%) had a response lasting 6 months or longer and 7 patients (18%) had a response lasting 12 months or more. Without a head-to-head study it is impossible to compare the efficacy of the two products. Nevertheless, the lead time advantage enjoyed by Pemazyre suggests that the real market opportunity for derazantinib lies beyond iCCA.

The bladder (urothelial) monotherapy market also appears at first glance to be a race where derazantinib is a laggard. The approval of J&J's Balversa (erdafitinib) in April 2019, represented the first FDA approval of an FGFR inhibitor and followed the results of a Phase 2 trial where patients possessed either one of several FGFR-3 mutations or FGFR2 gene fusions. The ORR was 32.2% with Balversa also benefiting from Breakthrough Therapy Designation and Priority Review. For Balversa we note that the prescribing label contains a warning, like Pemazyre, for ocular disorders as well as hyperphosphataemia (although not a Black Box warning), suggesting a class effect. Balversa is currently undergoing a confirmatory trial (THOR) which is comparing it to chemotherapy and Keytruda.

The bladder cancer indication is a significantly larger opportunity than iCCA. With approximately 70,000 new cases in the US alone, bladder cancer is a relatively common cancer. It is also relatively complex to treat. While approximately 70% are low grade superficial tumours they have a high propensity to recur post resection and adjuvant chemotherapy. As a result, treatment is often lifelong and consequently expensive. We have seen conflicting numbers for the number of patients harbouring FGFR mutations with a general consensus of 15-20% for all FGFR alterations. For patients harbouring an FGFR3 mutation the number appears to be closer to 12%. We note at the time of Balversa approval, that originator J&J was touting blockbuster status with peak sales expectations over $1bn.

For both Balversa and Pemazyre the race is on to investigate their respective therapies in other FGFR driven tumours. Apart from apparently different specificities with respect to the four FGFR receptors, there appears to be little in the way of differentiation. What is clear though is that in monotherapy, both Incyte and J&J have significantly greater resources to deploy. Fortunately, Basilea has been able to capitalise on some unique properties of derazantinib – inhibition of colony stimulating factor-1 (CSF-1).

Basilea seeking to confirm differentiated profile by following the science

To be fair, the iCCA opportunity remains an important validation of the potential of derazantinib as a monotherapy with the data generated so far supportive of its efficacy and safety in the iCCA indication. Even here, there has been a lack of data generated in patients with different types of alterations. The broad applicability of derazantinib to the iCCA setting was confirmed with positive data presented at MAP (2020), demonstrating the efficacy of derazantinib in patients with gene mutations and amplifications, complementing the data in the FGFR2 fusion population.

Outside of the fast to market iCCA indication, Basilea has been intent on following the science to identify a position for derazantinib in the highly competitive FGFR inhibitor class. While there has already been considerable interest in the potential for combining members of the FGFR inhibitor class with other agents, it is the combination with the checkpoint inhibitors that has caught the imagination of the clinicians and investigators.

We believe that for the other members of the FGFR inhibitor class, the initial focus has been on providing an alternative to the checkpoint inhibitors in those indications where FGFR inhibition may prove to be a more effective means of generating a successful tumour response. However, with the popularity of the CKIs, there have been efforts to combine available CKIs with the current crop of FGFR inhibitors. These are early days, and the rationale isn't entirely clear, we believe. Elsewhere, the combination of chemotherapy with CKIs has focussed on the potential to improve the immunogenicity of the tumour to improve response rates to CKIs. Indeed, this approach has so far been the most effective with chemotherapy providing the benefit of near-term response with the durability of checkpoint inhibition.

Preclinical data appear to be supportive of the combination of CKIs with FGFR inhibitors as an approach to improve the immunogenicity of the tumour microenvironment. As things stand it is clear that not everyone will benefit from immunotherapy. The combination of FGFR inhibition and checkpoint inhibition would appear to be a sensible approach given that these are potentially complementary approaches. Preclinical data generated in a mouse model of NSCLC demonstrated that a combination of an FGFR inhibitor (erdafitinib) with a PD1 inhibitor, resulted in similar tumour control as FGFRi monotherapy initially but resulted in increased survival compared to monotherapy. Encouragingly, these data were generated in a mouse model that was refractory to PD1 blockade.

Further analysis was undertaken with the data suggesting that FGFR inhibition was associated with increased T-cell infiltration and a decrease in immunosuppressive cells (Tregs) while the combination resulted in additional alteration to the tumour microenvironment which included lower levels immunosuppressive tumour associated macrophages (TAMs) and an increase in important cells such as natural killer (NK) cells and activated T-cells. Interestingly, FGFR activation has previously been associated with non-immunogenic (anti-PD1 refractory) tumours suggesting that, like chemotherapy-based approaches, targeted FGFR inhibition could boost T-cell infiltration, deliver re-expression of tumour associated antigens and reverse the refractory nature of these tumours to PD1 inhibition. These data, although preclinical, are highly encouraging with respect to extending the population of cancer patients who currently receive no benefit from immunotherapy.

While efforts to evaluate the combination in the clinic are relatively early, the data generated so far in support of the combination have been generally lacklustre. Data are sparse but we note that the combination of the PD-L1 inhibitor Imfinzi (durvalumab) with the FGFR1-3 inhibitor AZD4547 appeared to deliver only a modest incremental benefit in BISCAY (urothelial cancer) in a randomised Phase 2 design, although we note that patients exhibited low biomarker activity (low PD-L1 and tumour mutational burden). Arguably, these data emphasise the importance of ensuring that the patient population is biomarker enriched to ensure an adequate response.

As mentioned previously, Basilea believes that it can differentiate its approach with derazantinib by capitalising on its ability to bind to CSF1R and the prospect of augmenting the checkpoint inhibitor class.

Mechanism of action of CSF/PD-L1 and TAMs

Source: A. Ghasemzadeh et al

Interestingly, in our endeavours to review the prospects for the FGFRi class generally, one note of caution resonates. This caution relates to the risk of resistance emerging or escape pathways being utilised by the tumour. Perhaps the combination of FGFR and CSF1R, could represent a more optimal approach in the longer term than those which do not possess additional activity against other relevant TKIs. We have previously noted that it has been the toxicity profile that has blighted the development of a FGFR containing pan-TKI approach. Clinical development of specific CSF1R inhibitors suggests that they are associated with manageable toxicity in general with the conclusion that this approach would offer an attractive combination candidate.

Basilea has sought to explore the potential of derazantinib in combination with the checkpoint (PD-L1) inhibitor Tecentriq (atezolizumab). The intention here is to exploit the potential for derazantinib to block colony-stimulating-factor-1 receptor (CSF1R) as well as FGFR. Given the varying properties of the FGFR inhibitors, blocking CSF1R appears to be a differentiating feature. In this regard, Basilea has entered into a clinical supply agreement with Roche with respect to exploring the combination in urothelial and gastric cancer.

FGFR-inhibitors show differences in kinase-inhibition profiles

Source: Company Reports

The combination appears to be relevant to re-programming tumour-associated macrophages (TAMs). While macrophages are better known for their role in eliminating bacteria, facilitating wound healing as well as ensuring a response against tumour cells, TAMs can also be central to the much more insidious process of tumour metastasis.

TAMs are important in that they appear to be tumour inducing and are involved in disease progression through various processes. These include the proliferation, invasion and metastasis of tumour cells as well as preventing T-cell -mediated anti-tumour responses. Successful intervention here should be beneficial in limiting tumour growth and progression.

Indeed, although macrophages perform diverse functions as they regulate the immune response, TAMs also perform multi-functional roles in tumour progression, including initiation and promotion, immune regulation, metastasis and associated angiogenesis. This transition from a normal role in immune surveillance to a pro-tumourigenic role is termed macrophage polarisation. This transition to a polarised immunosuppressive state is catalysed by a number of signals and growth factors, arguably the best characterised of which is colony stimulating factor 1 (CSF-1).

The milieu of cells that represent the tumour microenvironment frequently serve as a barrier to immune activity and is one of the critical reasons why immunotherapy may have limited clinical efficacy in certain immunologically cold cancers. CSF-1/CSF1R inhibition as a therapeutic approach represents a novel class of immunomodulatory immunotherapeutic confirmed, we believe, with the approval of Turalio (pexidartinib) for TGCT (tenosynovial giant cell tumour).

Turalio is a novel small molecule inhibitor of CSF1R, cKIT & Flt3 receptor and is a more potent inhibitor of CSF1R than imatinib or nilotinib. Encouragingly, in preclinical studies, pexidartinib was observed to shift the polarisation of TAMs from their immunosuppressive state. We note that the prescribing label contains a Black Box warning for hepatotoxicity. It appears that although raised liver enzymes should be considered a class effect, it appears that this is not associated with either functional liver damage or indeed damage to hepatocytes.

Unsurprisingly, the pharmaceutical industry has recognised the potential of a combination of CSF-1/CSF1R inhibition with the CKIs. As a result, there are numerous clinical trials ongoing to evaluate these inhibitors with the available checkpoint inhibitor class.

CSF-1 and CSF1R inhibitors in combination with checkpoint inhibitors

Source: Calvine Partners Research

These are still early days and, perhaps unsurprisingly, the industry has struggled to replicate encouraging preclinical data in the clinical setting. Nevertheless, we note that there have been some encouraging signs of anti-tumour activity in difficult to treat patient populations. We are particularly encouraged to see responses in patients with tumour types which have historically proven to be intractable to checkpoint inhibition.

Derazantinib well placed to deliver on its broader activity

Late-breaking abstracts, presented at the AACR-NCI-EORTC conference in Boston, confirmed that derazantinib has similar activity against CSF1R as well as FGFR 1, 2 & 3. With derazantinib possessing potent activity against CSF1R, a unique property amongst the current crop of FGFR inhibitors, we expect it to be able to boost the activity of immunotherapy particularly in those cancers where CKI activity has been more muted. More broadly, given that the industry generally has been attempting to identify relevant combinations for the CKIs – with little success to date (IDO/TDO for example), derazantinib could provide an excellent combination in those FGFR driven tumours where CKIs may be less than optimal. Indeed, even where CKI use has been well established and successful (unlike urothelial cancer), perhaps derazantinib could improve response rates and indeed, bring a higher proportion of patients into the CKI sensitive state.

While this is a very exciting possibility, we concede that these data remain sparse with little clinical evidence available to justify these claims. Nevertheless, as mentioned previously there are several clinical stage development programmes ongoing which are evaluating the possibility of targeting CSF-1/CSF1R in multiple cancer settings in combination with various checkpoint inhibitors.

From Basilea's perspective, urothelial cancer appears to be an excellent candidate for combination with checkpoint inhibition. While 15-20% of muscle-invasive urothelial cancer patients suffer from an FGFR mutation, response to immunotherapy has been lacklustre in this largely elderly patient population. Despite the initial approvals of Tecentriq and Keytruda, the FDA updated the label, limiting the use of both agents. The label update followed the observation of decreased survival in patients receiving monotherapy when compared to standard (platinum-based) chemotherapy. Given the high response rates (ORR~35%) in urothelial cancer patients receiving FGFR inhibitor therapy (reflected in the approval of Balversa), the combination with a checkpoint inhibitor would appear to be a potentially transformational approach to the treatment of urothelial cancer; particularly the case with those who are ineligible for platinum-based treatment.

Basilea has designed the FIDES-02 Phase 1/2 study to recruit patients who are cisplatin-ineligible or who have failed on first-line therapy (or prior treatment with FGFR inhibitors). The trial comprises three open-label studies in urothelial cancer with an FGFR gene alteration to assess the activity of derazantinib alone or in combination with Tecentriq. One additional arm in the study established the recommended phase 2 dose of the combination of derazantinib and Tecentriq. The primary endpoint completion date is 2022. We have previously noted that 25% of patients in the Balversa study also received a CKI, however, its contribution to the result is unknown. In FIDES-02 we will have direct evidence of the synergistic activity of derazantinib and Tecentriq. From a risk management perspective, even if the combination arm fails to show a benefit over derazantinib alone, we are hopeful the monotherapy arm has been de-risked given the Balversa data.

Inevitably, one of the concerns with combining an FGFR inhibitor – particularly one which also inhibits CSF1R, will be increased toxicity. However, we already know that CSF1R inhibition toxicity can be managed and that candidates are already being combined with immunotherapy.

As it seeks to follow the science and maximise the potential of derazantinib, Basilea has identified gastric cancer as the 3rd indication for derazantinib. Gastric cancer often presents late, and even in those who receive potentially curative surgery, the cancer returns in over 60% of patients within 5 years. For these patients the outlook is grim and even with the introduction of targeted agents, the 5-year survival rate remains stubbornly low (<10%). This is a highly complex and heterogeneous disease and we note that efforts are ongoing to identify molecular subtypes in order to tailor therapeutic intervention and improve outcomes.

FGFR is a fairly recent target in gastric cancer with approximately 10%-15% of patients harbouring a FGFR alteration (amplification). Consequently, these patients represent an obvious target for FGFR inhibition and derazantinib has recently entered the FIDES-03 study. At the same time, although the checkpoint inhibitor class has been shown to generate durable and significant responses, this has been in a minority of gastric cancer patients. Consequently, FIDES-03 will also evaluate the combination of derazantinib and Tecentriq and in a separate cohort the combination with ramucirumab and paclitaxel.

Although the incidence of gastric cancer has decreased over the past 50 years, it remains a significant unmet need. One of the reasons for the reduction has been an improvement in H. pylori diagnosis and eradication. However, here are still approximately 1m cases diagnosed globally every year with circa 27,000 new cases in the US per year resulting in 11,000 deaths. It is the 5th most common cancer and the 3rd leading cause of cancer death. While the 5-year survival rate may look relatively good at 31%, this hides the very low survival rate once metastatic (18% Stage IIIC compared to 89% for Stage IA).

Although Basilea has relied on its own preclinical data as it identified the relevance of gastric cancer to derazantinib, we note that there has previously been encouraging data generated by the now discontinued FGFRi, AZD4547. Here gastric cancers, which harboured high level FGFR2, generated a robust response to AZD4547. More recently, bemarituzumab (a selective FGFR2 monoclonal), has delivered positive results in the Phase 2 FIGHT trial. Here, patients with FGFR2b+, non HER2 positive front-line advanced gastric or gastroesophageal junction cancer benefited from a statistically significant improvement in PFS, OS and ORR.

While there may not be an already approved proxy (such as Balversa or Pemazyre) for gastric cancer that would reduce the development risk in the same way that there is for biliary and bladder cancer, bladder cancer is a wide open opportunity for derazantinib. Although we have not included the bladder cancer opportunity in our financial model, our research suggests that even a modest 25% share of the 15% of patients who harbour an FGFR alteration would represent a $200m opportunity in the US and Europe alone. When combined with $400m for a potential 20% share of the UC market and $50m for the iCCA indication, all on an unrisked basis, the financial reward for Basilea (and a potential partner) could be highly lucrative.

Effectively, Basilea appears to have followed a well-planned clinical evaluation of derazantinib, taking into account the intensifying competitive environment. The iCCA and urothelial cancer indications should represent a low-risk route to market in monotherapy given positive results and approval elsewhere. However, given the competitive situation, expectations remain rightly modest.

However, we view derazantinib success in iCCA as a key first step in establishing Basilea as a cancer company, complementing the historical reliance on the anti-infectives portfolio. In the longer term, should the additional activity against CSF1R deliver on its potential, this would transform the market potential for derazantinib and Basilea's prominence in this field. Indeed, we believe that derazantinib could potentially be in a leadership position in the urothelial cancer setting which is altogether a larger opportunity; not to mention the gastric cancer opportunity where competition is minimal and the unmet need considerable.

Finally, there will clearly be other FGFR driven tumours that will be tractable to an FGFRi approach. For Basilea, we suspect that the investment and resources required to capitalise on these opportunities in an expeditious fashion will require input from a development partner with deep pockets and a desire to be a major participant in the oncology field. With this in mind, we can see why attraction of a near-term partner may be possible after positive iCCA data and removal of risk associated with derazantinib development, but we also suspect that a much more lucrative and wide ranging agreement could be achieved based on positive results from the combination with Tecentriq later in 2021.

Recapitulating on the data

A registrational Phase 2 trial in iCCA patients is currently underway in the US, Canada and Europe. Around 100 second-line patients are being investigated in a biomarker-driven study (identifying FGFR2 fusions). Results are expected in the near term. An interim analysis provided encouraging evidence of activity in FGFR driven tumours, with an ORR of 21%, and a manageable safety profile consistent with its mechanism of action.

Furthermore, the disease control rate, reflecting the proportion of patients with a partial response or with stable disease, was 83%. When combined with the proof of concept (PoC) data, which showed that treatment with derazantinib was associated with substantially longer duration on therapy than on prior second-line chemotherapy, we remain confident that the full data readout due later in 2020 should support a regulatory filing. It should also be noted that the interim readout did not represent the full maturity of the data, and more responses may occur after the interim analysis.

As mentioned previously, there has been a dearth of data on responses to different FGFR alterations. The broad applicability of derazantinib to the iCCA setting was confirmed with positive data presented at MAP (2020) demonstrating the efficacy of derazantinib in patients with gene mutations and amplifications complementing the data in the FGFR2 fusion population. The similarity in the data with respect to both PFS and days on therapy are reassuring and expand the patient population to approximately 20% of the iCCA population (15% FGFR2 gene fusions + 5% FGFR2 mutations/amplifications).

Source: Company Reports

The positive nature of the data delivered to date confirms the merits of the fast to market approach. While the initial indication may be modest, we believe that the combination of observed efficacy along with acceptable tolerability/ toxicity bodes well for development extension into larger FGFR2 driven cancers where the real opportunity for derazantinib lies.

Risks

Basilea's currently marketed products are out-licensed to third parties, which suggests that the company has little influence with the end customer. That said, in the case of the anti-fungal Cresemba, Astellas and Pfizer bring market leading anti-fungal franchises with good execution to date.

While the antibiotic Zevtera is already marketed outside of the USA for the treatment of CAP and HAP (excluding VAP), we see the more significant market opportunity in the Staph aureus bacteraemia indication. While data from those patients in the four completed Phase III trials which suffered from a bacteraemia are supportive of this approach, there is uncertainty associated with this difficult to treat patient population. This uncertainty is reflected in the probability adjustment we have employed. At the same time, approval of ceftobiprole in the US requires a positive outcome for both the ABSSSI indication (already achieved) as well as the bacteraemia indication.

Our forecasts suggest that Basilea will self-commercialise ceftobiprole in the US and we have burdened the income statement with the costs associated with such an eventuality. Basilea, on the other hand, has communicated that it will seek to attract a commercial partner for Zevtera in the US, and while there is a partnering risk associated with this strategy, we believe that Basilea has a successful track record in this regard.

The un-partnered oncology programmes are still relatively early stage, apart from the recently in-licensed derazantinib. While there is a risk that the oncology pipeline may be associated with delays and potentially negative and/or inconclusive clinical trial results, the positive interim analysis in iCCA for derazantinib largely de-risks this programme in this indication. This is a highly competitive field, but we note Basilea's endeavours to differentiate derazantinib and we would highlight the combination with the checkpoint inhibitors in urothelial cancer as a starting point.

Our financial forecasts suggest Basilea will experience several years of losses. With our expectation of a 2023 launch for ceftobiprole, our forecasts do not incorporate the expected upfront payment that the company would receive from a commercial partnership. Consequently, we are forecasting a negative cash position for several years but recognise that there are many puts and takes to our forecasts. Additionally, we have effectively taxed the company on its first year of profits despite the observation that there are significant tax losses which will significantly reduce the tax burden in the near term.

Summary and Financial Model

The near-term financials at Basilea are well underpinned by sales and royalties received from Cresemba, and to a lesser extent Zevtera. Despite the significant investment in building the oncology franchise, our sense is that the market is overlooking these efforts despite encouraging data to date. Perhaps this is unsurprising given that the competition has beaten derazantinib to the market in the two lead indications of iCCA and urothelial cancer. Additionally, the competitive environment for new targeted FGFR inhibitors is intense with numerous programmes underway evaluating apparently similar product candidates in biliary cancer, bladder cancer and other solid tumours.

Nevertheless, our analysis suggests that the market is too quick to dismiss Basilea's efforts. Even within iCCA, Basilea has generated substantial data on those patients who suffer from other mutations and alterations beyond FGFR2 fusions. It is clear to us also that Basilea is following the science as it seeks to identify the optimal positioning for derazantinib. The potential to also inhibit the CSF-1/CSF1R axis could be an important point of differentiation in this congested field. The manageable toxicity profile of the direct CSF1R inhibitors along with the observation that Basilea has been able to combine, both at the approved Tecentriq and optimal derazantinib doses, bodes well for the future we believe.

The role of tumour associated macrophages is now well characterised as it relates to cancer metastasis, with CSF-1 an important mediator of polarisation into the immunosuppressive state. As a result, CSF-1/CSF1R is now a key target for several drug development programmes as they seek to identify a direct inhibitor. Inevitably, there will be concern regarding the untried combination of an FGFR/CSF1R inhibitor with a checkpoint inhibitor, but we are encouraged by data elsewhere that highlights the ability of a direct CSF1R therapy to provide responses where CKIs alone have been poor.

If confirmed in clinical trials, derazantinib offers the intriguing prospect of a targeted FGFR inhibitor which should also act to remove the negative immunosuppressive impact of TAMs, so that checkpoint inhibition becomes a viable option in these patients. First up is the urothelial cancer indication where FIDES-02 should deliver a result in H2 2021 in combination (monotherapy H1 2021). Given that Balversa has already delivered a positive result here in monotherapy, this should be a relatively de-risked opportunity for derazantinib, particularly with the addition of Tecentriq. Inevitably, we suspect that there will be comparisons with respect to respective ORRs. If these data are positive, our expectation is that the market will begin to discount the potential de-risking of the gastric cancer indication. Indeed, we expect Basilea to continue to evaluate the clinical options open to derazantinib to fully capitalise on its potential. Should the combination with Tecentriq prove positive, then we expect the competitive noise to be less of an issue than it is today.

Basilea is in a very fortunate position, possessing a differentiated participant in a fast-growing class with potentially very broad applicability. With limited resources, Basilea has chosen to follow the science and fund derazantinib clinical evaluation selectively. FIDES-03 in gastric cancer is an excellent example, with preclinical data used to identify relevant indications to pursue derazantinib in combination with Tecentriq. Ultimately, we would expect Basilea, potentially along with a strategic partner, to continue its evaluation of derazantinib in other FGFR driven tumours, but clearly much will depend on the data. We have incorporated risk-adjusted sales only for the iCCA indication and not for other potential indications or combinations, suggesting significant upside to our current forecasts. As we have mentioned previously, we will adjust our assumptions post data and any partnering event.

Our model suggests management will continue to fund R&D carefully while recognizing the highly competitive nature of the FGFR class. The clinical profile is becoming clearer, and there are many data points ahead which will help direct Basilea's investment in derazantinib. Consequently, we are forecasting stable R&D funding for the foreseeable future, with R&D spend only set to rise in 2024/5 as growing revenues allow.

However, there are many puts and takes to our forecasts. The company has the potential to reduce spending, particularly in R&D as the costs of the Phase 3 ceftobiprole programme dissipate. There is also uncertainty over additional in-licensing efforts and the need to increase spending to support these as yet unidentified programmes. On the plus side, we have no insight into the size and timing of the anticipated upfront payment associated with a ceftobiprole agreement.

Additionally, we have taxed the company on its first year of profits despite the existence of significant net operating losses carried forward. These losses should reduce the tax burden in the near term. Furthermore, there is the potential for the company to re-finance debt or raise cash through the sale of equity if desired.

With this in mind, we note the additional convertible debt raised by the company in June this year. With $200m of convertible initially due in 2022, this has been something of an overhang for the company, particularly as it entered a net debt position. In July, Basilea retired circa 25% of the outstanding 2022 bonds, while at the same time issuing new convertible debt boosting the cash position. We expect Basilea to take additional steps to reduce the overhang associated with the remaining 2022 bond over the next two years.

Valuation

As a development based, loss-making enterprise, Basilea cannot realistically be valued on a near term earnings multiple. Instead, we believe that a discounted cash flow (DCF) methodology, using a range of discount rates, is more informative. To this end, we have provided a summary schematic of our DCF assumptions and a valuation range based on a range of discount rates and terminal growth rates.

Generally, we believe that early-stage venture investments in this sector should employ a 35% discount rate, while long-established, profitable, pharmaceutical companies with a strong track record of cash generation deserve a lower discount rate, which is represented by a calculated WACC of circa 8.5%. Looking within this spectrum, we believe that the investment case for Basilea benefits from the attraction of heavyweight pharma partners for Cresemba in particular, which serves to de-risk to an extent, commercial execution risk. Even for the antibiotic programme, Basilea has previously generated supportive data in bacteraemia patients. As a result we have used a 12.5% discount rate, which generates an NPV of CHF120 per share. Furthermore, we can foresee several events that could significantly reduce the risk and discount rate. These events include additional data on the rest of the pipeline, particularly within oncology, and the attraction of a suitable partner for ceftobiprole in the US.

Basilea Discounted Cash Flow Valuation (CHF per share)

Basilea Income Statement (CHF 000s)

Basilea Balance Sheet (CHF 000s)

Disclosures

Calvine Partners LLP is authorised and regulated by the Financial Conduct Authority in respect of UK investment advisory and arranging activities.

This publication has been commissioned and paid for by Basilea Pharmaceutica and as defined by the FCA is not independent research. This report is considered to be a marketing communication under FCA rules, and it has not been prepared under the laws and requirements established to promote the independence of investment research, and it is not subject to any prohibition on dealing ahead of the dissemination of investment research. The information provided is widely available to the public.

This report in the United Kingdom is directed at investment professionals, certified high net worth individuals, high net worth entities, self-certified sophisticated investors, eligible counterparties as defined by Financial Services and Markets Act 2000 (Financial Promotion) Order 2000. The report may also be distributed and made available to persons to whom Calvine Partners is lawfully permitted. This publication is not intended for use by any individual or entity in any jurisdiction or country where that use would breach law or regulations, or which would subject Calvine Partners or its affiliates to any registration requirement within such jurisdiction or country.

Calvine Partners may provide, or seek to provide, services to other companies mentioned in this report. Partners, employees, or related parties thereof may hold positions in the companies mentioned in the report subject to Calvine Partners’ personal account dealing rules.

Calvine Partners has only used publicly available information believed to be reliable at the time of this publication and made best efforts to ensure that the facts and opinions stated are fair, accurate, timely and complete at the publication date. However, Calvine Partners provides no guarantee concerning the accuracy or completeness of the report or the information or opinions within. This publication is not intended to be an investment recommendation, personal or otherwise, and it is not intended to be advice and should not be treated in any way as such. Any valuation estimates, such as those derived from a discounted cash flow, price multiple, or peer group comparison, do not represent estimates or forecasts of a future company share price. In no circumstances should the report be relied on or acted upon by non-qualified individuals. Personal or otherwise, it is not intended to be advice and should not be relied on in any way as such.

Forward-looking statements, information, estimates and assumptions contained in this report are not yet known, and uncertainties may cause the actual results, performance or achievements to be significantly different from expectations.

This report does not constitute an offer, invitation or inducement to engage in a purchase or sale of any securities in the companies mention. The information provided is for educational purposes only and this publication should not be relied upon when making any investment decision or entering any commercial contract. Past performance of any security mentioned is not a reliable indicator of future results and readers should seek appropriate, independent advice before acting on any of the information contained herein. This report should not be considered as investment advice, and Calvine Partners will not be liable for any losses, costs or damages arising from the use of this report. The information provided in this report should not be considered in any circumstances as personalised advice.

Calvine Partners LLP, its affiliates, officers or employees, do not accept any liability or responsibility with regard to the information in this publication. None of the information or opinions in this publication has been independently verified. Information and opinions are subject to change after the publication of this report, possibly rendering them inaccurate and/or incomplete.

Any unauthorised copying, alteration, distribution, transmission, performance, or display, of this report, is prohibited.