Basilea announced this morning that it has secured Innoviva Specialty Therapeutics as a distribution and license partner for the US commercialisation of its 5th generation cephalosporin antibiotic Zevtera (ceftobiprole). In its endeavour to maximise the commercial potential of ceftobiprole, Basilea sought to ensure that the partner has relevant anti-infective expertise, particularly in the key hospital setting. We believe that Innoviva fulfils that requirement demonstrated by its current portfolio, including Xerava (everacycline) and the recently approved Xacduro (sulbactam; durlabactam). Ceftobiprole looks to be a good fit for Innoviva, growing its anti-infectives portfolio. Ceftobiprole brings its key staphylococcus aureus bacteraemia (SAB) label, as well as acute skin and soft tissue infections (ABSSSI) and community acquired bacterial pneumonia (CABP) in the US. Innoviva Specialty Therapeutics is a wholly owned subsidiary of drug royalty company Innoviva which has grown its portfolio largely through acquisition. Xerava (originator Tetraphase) was added through the acquisition of La Jolla Pharmaceuticals, and Xacduro from the 2022 acquisition of Entasis.

Innoviva is an excellent partner for ceftobiprole

As expected, with Basilea seeking to ensure the maximum commercial return on its (and Barda’s) investment in the development of ceftobiprole, the agreement with Innoviva comes with a small upfront payment ($4m). Basilea will also receive tiered royalties on net sales in the high teens to mid-twenties percentage range and sales milestones of up to $223m. Additionally, Innoviva Specialty Therapeutics will purchase drug product from Basilea.

Management executing

With the partnering of ceftobiprole in the US, Basilea has delivered on the lofty objectives that it set out to establish itself as a leading global anti-infectives company. These attainments have included the acquisition of the novel Phase 3 anti-fungal fosmanogepix and securing funding for this and other pipeline programmes as part of a long-term agreement with BARDA. The funding agreement will cover approximately 60% of costs, up to $268m, over 12 years.

Notwithstanding the current lack of investor enthusiasm for anti-infectives, we believe that this enviable track record of execution effectively de-risks the investment case for Basilea. In particular, with Cresemba expected to suffer a loss of exclusivity from Q4 2027 in the US and Europe, revenues from US sales of ceftobiprole should go some way to offset any impact. In the longer term, we look forward to the clinical progress of fosmanogepix with the Phase 3 trial in invasive moulds due to start at the year end. When approved, we expect fosmanogepix to not only secure the longevity of the anti-fungal franchise but to take it to new heights with a peak sales potential of $1.2bn.

Basilea Income Statement (CHF' 000)

Source: Calvine Partners Research

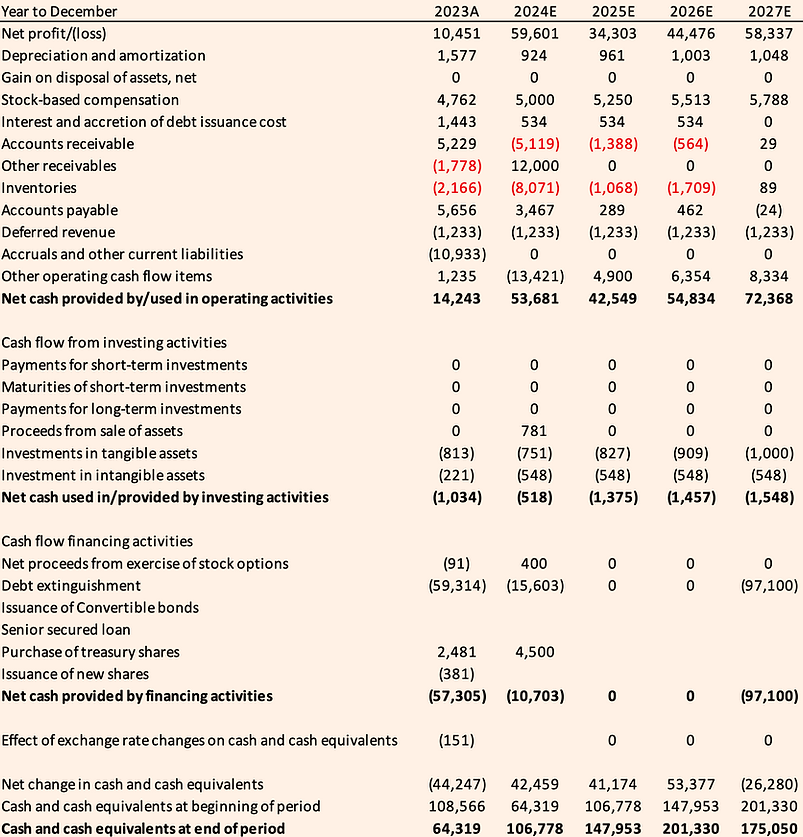

Basilea Cash Flow Statement (CHF' 000)

Source: Calvine Partners Research

Basilea Balance Sheet (CHF' 000)

Source: Calvine Partners Research

Disclosures

Calvine Partners LLP is authorised and regulated by the Financial Conduct Authority for UK investment advisory and arranging activities.

This publication has been commissioned and paid for by Basilea Pharmaceutica and as defined by the FCA is not independent research. This report is considered a marketing communication under FCA Rules. It has not been prepared under the laws and requirements established to promote the independence of investment research. It is not subject to any prohibition on dealing ahead of the dissemination of investment research. This information is widely available to the public.

This report in the United Kingdom is directed at investment professionals, certified high net worth individuals, high net worth entities, self-certified sophisticated investors, and eligible counterparties as defined by the Financial Services and Markets Act 2000 (Financial Promotion) Order 2000. The report may also be distributed and made available to persons to whom Calvine Partners is lawfully permitted. This publication is not intended for use by any individual or entity in any jurisdiction or country where that use would breach law or regulations or which would subject Calvine Partners or its affiliates to any registration requirement within such jurisdiction or country.

Calvine Partners may provide, or seek to provide, services to other companies mentioned in this report. Partners, employees, or related parties may hold positions in the companies mentioned in the report subject to Calvine Partners' personal account dealing rules.

Calvine Partners has only used publicly available information believed to be reliable at the time of this publication and made best efforts to ensure that the facts and opinions stated are fair, accurate, timely and complete at the publication date. However, Calvine Partners provides no guarantee concerning the accuracy or completeness of the report or the information or opinions within. This publication is not intended to be an investment recommendation, personal or otherwise, and it is not intended to be advice and should not be treated in any way as such. Any valuation estimates, such as those derived from a discounted cash flow, price multiple, or peer group comparison, do not represent estimates or forecasts of a future company share price. In no circumstances should the report be relied on or acted upon by non-qualified individuals. Personal or otherwise, it is not intended to be advice and should not be relied on in any way as such.

Forward-looking statements, information, estimates and assumptions contained in this report are not yet known, and uncertainties may cause the actual results, performance or achievements to be significantly different from expectations.

This report does not constitute an offer, invitation or inducement to engage in a purchase or sale of any securities in the companies mentioned. The information provided is for educational purposes only and this publication should not be relied upon when making any investment decision or entering any commercial contract. Past performance of any security mentioned is not a reliable indicator of future results and readers should seek appropriate, independent advice before acting on any of the information contained herein. This report should not be considered as investment advice, and Calvine Partners will not be liable for any losses, costs or damages arising from the use of this report. The information provided in this report should not be considered in any circumstances as personalised advice.

Calvine Partners LLP, its affiliates, officers or employees, do not accept any liability or responsibility with regard to the information in this publication. None of the information or opinions in this publication has been independently verified. Information and opinions are subject to change after the publication of this report, possibly rendering them inaccurate and/or incomplete.

Any unauthorised copying, alteration, distribution, transmission, performance, or display, of this report, is prohibited.