Basilea recently announced that it has secured funding of up to $268m through a multi-year Other Transaction Agreement (OTA) from BARDA to help its anti-infective research & development activities. The award is transformational with respect to progressing a range of key programmes. It is also a testament to the company's anti-infectives expertise. Importantly, the funding will be available for various programmes supporting its antifungal and antibacterial R&D endeavours. This flexibility is key to progressing its lead antifungal programme, fosmanogepix, and allows the company, along with BARDA, to move programmes in and out of the development pipeline. We believe this flexibility should lead to more expeditious development of candidates based on data and unmet need. Overall, the agreement is expected to fund approximately 60% of the development costs over the duration of the OTA.

Fosmanogepix is the key near-term beneficiary

Basilea has also disclosed that $29m of funding will be available initially to fund the development of the antifungal franchise benefiting both fosmanogepix and BAL2062. Fosmanogepix has recently started Phase 3 development for the treatment of candidaemia and/or invasive candidiasis, with a second Phase 3 trial targeting invasive yeasts and moulds, which will begin at the end of the year. We have previously incorporated costs of approximately $140m for the Phase 3 programme. With the OTA funding approximately 60% of development costs, Basilea is now in a stronger financial position to progress its overall anti-infective ambitions. Nevertheless, fosmanogepix remains the key and should ultimately provide longevity to the antifungal franchise after the expected loss of exclusivity for Cresemba in the US and Europe in Q4 2027. We expect the franchise to reach new heights given the broad spectrum of fosmanogepix, which targets most of the critical fungal infections highlighted by the WHO. The importance of fosmanogepix as a novel antifungal has been reflected in FDA conferring Fast Track status for various invasive fungal infections, including invasive aspergillosis, candidiasis and mucormycosis. Encouraging Phase 2 data suggests the Phase 3 programme has been substantially de-risked. Our peak sales estimate for fosmanogepix is $1.2bn based on its clinical profile.

Management executing

Successful in-licensing activities have secured the future of the anti-infectives franchise at Basilea and have the potential to create an anti-infectives powerhouse. The OTA agreement with BARDA further enhances Basilea's anti-infectives prowess and provides further proof that the company is a go-to partner for anti-infective assets. The future looks bright with a balanced pipeline of novel antifungal and antibiotic programmes. While we expect further in-licensing activities, we have been encouraged by the execution so far, particularly in the key antifungal field.

Securing the anti-infective franchise

The recent past at Basilea has been characterised by a clear desire to turn the company into one of the few global anti-infective powerhouses. We believe that Basilea is one of the few companies that truly understands not only the unmet medical needs in the anti-infective field but also what is required to deliver a successful commercial product. We sense that despite apparent investor reluctance to embrace the promise of the anti-infectives field, management has a clear vision and a determination to deliver. Securing a multi-year OTA with BARDA will continue a long-standing relationship with the organisation and help ensure the company's long-term anti-infectives ambitions.

The financial performance of Cresemba has facilitated the creation of a broad anti-infective pipeline. Noting that BARDA has the desire to help fund the development of novel treatments for critical infections, we were hopeful that the company could attract funding for the Phase 3 development of fosmanogepix. Securing a multi-year OTA, which provides up to $268m of funding over up to 12 years, represents another transformational event for the company and goes well beyond our initial expectations. BARDA uses OTAs to "…foster innovation and promote collaboration" and are a crucial element of the US government's preparedness for various threats, including, in the case of Basilea, emerging infectious disease threats.

Awareness of the growing threat from emerging antifungal infections has been boosted by the WHO, which published a list of critical fungal infections in 2022 for the first time, increasing the profile significantly and increasing the need for novel antifungal treatments.

WHO fungal priority pathogens list

Source: World Health Organization

The ongoing success of the antifungal Cresemba has provided an excellent road map and the financial resources to build and progress an enlarged pipeline of anti-infective opportunities. With Cresemba moving towards loss of exclusivity in key markets of the US and Europe, there has been a sense of urgency to replenish the pipeline and provide reassurance that the company's recent profitable status will continue. In the near term, it is also important to remember that outside of the US and Europe, Cresemba is still relatively early in its life cycle in important markets such as China and Japan.

Transforming the antifungal franchise

Although the therapeutic focus for Basilea comprises both antifungals and antibacterials, there is a recognition that antifungals offer a larger commercial opportunity. Not only has there been a dearth of new antifungals, but emerging resistance has also become more of an issue.

It is important to note that while Cresemba may be subject to loss of exclusivity from Q4 2027 in the US and Europe, it is still very much in its growth phase despite this apparent maturity. The risk of serious invasive fungal infections continues to increase as procedures which drive growth in the immunocompromised patient population increase. These are well-understood and include organ transplantation and more aggressive cancer treatments.

The first addition to Basilea's antifungal pipeline was BAL-2062 (formerly GR-2397), a novel first-in-class antifungal agent with activity against clinically important moulds such as Aspergillus spp, including those resistant to currently available therapies. The commercial relevance of this acquisition is clear with Invasive Aspergillus (IA), the principal revenue generator for Cresemba, and potentially providing an alternative where resistance is suspected.

The acquisition of fosmanogepix, on the other hand, has been a transformational event and promises to take the anti-infective franchise to new heights. Crucially, fosmanogepix demonstrates activity against almost all the problem fungal infections highlighted on the WHO list. As such, should the Phase 3 programme confirm its broad spectrum and clinical activity, we believe that commercial success will be assured.

BAL2062 the first component of Basilea's growth strategy

BAL2062 is the first of a new class of siderophore-like hexapeptide antifungal agents. BAL2062 is differentiated by its novel mechanism of action that includes rapid fungicidal activity, with data generated to date suggesting activity against a range of difficult-to-treat fungal pathogens (including azole-resistant strains). The rapid reduction in fungal burden could be a highly attractive feature of BAL-2062, as well as a lack of cross-resistance to existing antifungal classes (such as the azoles).

BAL2062 originated at Astellas and is a naturally derived cyclic hexapeptide from the Malaysian leaf litter fungus. Its mechanism of action is based on the use by fungi (and other pathogens) of the siderophore ferrichrome. Fungi require ferrichrome to scavenge for essential iron when levels are low. Importantly, it is transported in fungal cells by the SIT1 transporter, and fortunately, since human cells do not possess a SIT1 transporter, BAL2062 should have minimal toxicity.

Although the principal commercial target is likely to be invasive aspergillus infections, BAL2062 also has activity against other important fungal pathogens, including Candida glabrata and Fusarium solani.

These remain early days for BAL2062, with Phase 1 clinical evaluation showing it to be safe and well tolerated. BAL2062 also benefits from QIDP and Fast Track designations for IA. Basilea intends to flesh out the profile of BAL2062 further, with the intention of commencing Phase 2 trials in 2025. The addition of BARDA funding should help accelerate development should BAL-2062's attractive profile warrant further development.

Fosmanogepix late-stage clinical trials now underway

We have previously highlighted the very attractive profile of fosmanogepix. Fosmanogepix is the first from the new 'gepix' class and inhibits fungal cell wall synthesis. It targets GPI-anchored protein maturation, inhibiting Gwt1 in the GPI biosynthesis pathway. Despite its evolutionary conservation, important differences in the GPI pathway in humans and other organisms allow for the development of inhibitors with excellent selectivity. This apparent selectivity has been borne out in clinical studies, which confirm its benign safety profile.

We are aware of at least two novel antifungals with activity against Gwt1. One of these is fosmanogepix, while gepinacin development has been compromised by its instability, and it offers no competition to fosmanogepix.

Preclinical and clinical data suggest that fosmanogepix has a differentiated and highly relevant profile. It has high bioavailability (>90%), providing the potential for both oral and IV preparations. This is relevant to the extent that the echinocandins can only be delivered by the IV route. The importance of the echinocandins is that they represent the first line of treatment for Candida auris infections where increasing resistance to the azoles has become an emerging concern.

We believe that fosmanogepix’s broad spectrum against all priority pathogens and activity against resistant fungal infections could take the anti-infectives franchise at Basilea to new heights. For example, while some of the commercial success enjoyed by Cresemba has been attributed to its extended spectrum, fosmanogepix, as a novel agent, has activity against azole-resistant Candida species. More recently, C. auris and C. glabrata have proven to be problematic fungal infections in the US. Moreover, fosmanogepix post-approval should possess a much broader label than Cresemba. Importantly, fosmanogepix has also displayed activity against other rare, difficult-to-treat moulds, which were typically resistant to other antifungal agents. Furthermore, fosmanogepix displayed activity against Aspergillus resistant to echinocandins and fluconazole.

The broad spectrum and potency of fosmanogepix have been demonstrated in various animal models. Several key attributes have been confirmed, including its ability to reduce fungal burden, particularly in key organs such as the brain, where the echinocandins have negligible activity. Overall, fosmanogepix has a good volume of distribution, penetrating many important tissues and organs, including the liver, lung, and eye.

As a novel first-in-class antifungal, resistance to fosmanogepix should be a distant concern in a real-world environment. However, we note the concern regarding the potential introduction of the pesticide aminopyrifen and the heightened risk of emerging resistance associated with its similar mode of action. Nevertheless, given that fosmanogepix has demonstrated both in vitro and in vivo activity against strains of Aspergillus and Candida (arguably the key near-term commercial targets for fosmanogepix) which are resistant to the echinocandins, amphotericin B, itraconazole and fluconazole, we believe that the differentiated profile of fosmanogepix suggests that it should be an important new treatment option.

Clinical development of fosmanogepix

Three Phase 2 studies have been completed in patients with candidaemia, including that caused by C. auris and invasive mould infections. C. auris has been associated with high mortality rates (circa 60%) in patients hospitalised with a C.auris infection. Resistance to existing classes of antifungals has been a characteristic of almost all C. auris strains. The rapid emergence of C. auris, its MDR, and its associated high mortality rate have resulted in various health authorities highlighting it as a fungal infection of significant concern. The CDC has highlighted the increasing prevalence of C. auris infections in the US. Consequently, CDC has designated C. auris as an urgent antimicrobial resistance threat in the US. In March 2023, the CDC issued a warning regarding the increasing risk of infection from drug-resistant C. auris following a spike in cases in California.

Phase 3 underway

Reflecting the unmet need and the commercial opportunity, two Phase 3 trials are planned, one targeting candidaemia/invasive candidiasis and a second targeting invasive mould infections.

Fosmanogepix global Phase 3 programme

Source: Company Reports

The first Phase 3 study, Fosmanogepix Against Standard-of-care Treatment in Invasive Candidiasis (FAST-IC), was initiated in September 2024. This study is a global, randomised, double-blind trial intended to show non-inferiority to standard of care. The trial aims to enrol 450 patients and will compare fosmanogepix to caspofungin – both offering oral step-down options. The primary endpoint agreed with FDA is 30-day survival, while for EMA approval, the primary endpoint is overall response at the end of study treatment.

The invasive mould study is open-label and randomised and is expected to enrol about 200 patients. The study aims to compare fosmanogepix versus best available therapy against a broad range of clinically and commercially relevant invasive fungal infections, including IA, Fusarium spp, Scedosporium spp, Mucorales, Lomentospora prolificans as well as other multi-drug-resistant moulds. This study is expected to start around year-end 2024. Given that fosmanogepix has obtained Fast Track status from FDA for seven different fungal infections, we believe that, ultimately, fosmanogepix will be relevant to a broad range of critical fungal pathogens.

Notably, the Phase 3 trials for fosmanogepix are global, suggesting a less protracted launch than Cresemba in these important markets. Inevitably, given the expected extended profile of fosmanogepix and its relevance to a broader range of problematic infections, we suspect there will be significant interest in expeditiously making it available to patients in all markets.

In that regard, we note the importance of expanded access programmes (EAPs), which provide access to novel treatments ahead of approval in that geography. Supporting the use of fosmanogepix as part of an EAP are the data already generated in the clinical programme as well as the recent report in NEJM of its successful, compassionate use in immunocompetent patients as part of an outbreak of Fusarium solani meningitis at two clinics in Mexico, among patients who received epidural anaesthesia. Of the thirteen patients identified in the article and treated with existing antifungal agents, nine died, while three out of four who received fosmanogepix survived. Additional (postmortem) analysis showed that the fungus causing the outbreak was resistant to all available antifungals except fosmanogepix.

New antifungals moving through development

The acquisition of fosmanogepix has been timely. Not only is Cresemba moving towards maturity in the major markets of the US and Europe, but the competitive environment is also beginning to show signs of intensifying with several novel antifungals in clinical development. Nevertheless, we believe that the profile of fosmanogepix suggests that it has a highly competitive profile.

New antifungals

Source: Company Reports

Looking at the competitive environment in more detail, we note that in May 2022, F2G, the originator of olorofim, received $100m in upfront payments with the potential to receive up to a further $380m in regulatory and commercial milestones as well as double-digit sales royalties. However, olorofim received a complete response letter from FDA in June 2023 following its application for approval with a proposed label for the treatment of invasive fungal infections in patients who have limited or no treatment options.

The antifungal pipeline at Scynexis now features its second-generation "fungerp" SCY-247. SCY-247 looks to have potent activity against a broad range of fungal infections, including multi-drug-resistant strains, including azole-resistant Candida and Aspergillus spp. If successful, SCY-247 could capitalise on the use of the echinocandins as first-line treatment options in invasive fungal infections caused by Candida and Aspergillus. SCY-247 has activity against resistant strains and appears more potent (greater bactericidal activity) than ibrexafungerp against resistant strains of C. auris and offers both IV and oral preparations.

While the profile of SCY-247 looks promising, it is still in early development, with IND enabling studies currently ongoing with Phase 1 studies expected to start later in 2024.

Risks

Basilea's business model currently involves partnerships and out-licensing to third parties, suggesting little influence over sales performance. Nevertheless, execution on key product Cresemba has been through highly appropriate partners (particularly Astellas and Pfizer), and we believe this model has worked well for Basilea and its partners.

The key to maximising ceftobiprole's value in the US is attracting a commercial partner. There remains a partnering risk until an appropriate partnership is secured. Basilea has historically proven to be adept at securing relevant commercial partners.

Our concerns over the endolysin approach and the early-stage nature of the LptA inhibitor programme suggest that there is still a genuine risk of failure. At this stage, we have not included either programme in our financial model until more compelling data are generated. In any event, we expect Basilea to continue replenishing its pipeline with interesting programmes.

Financial Model and Summary

Securing a large multi-year OTA with BARDA has further enhanced Basilea's ambitions to become a leading anti-infectives company. Along with its successful in-licensing activities, the additional funding further establishes the company's position as a global anti-infectives powerhouse.

The financial flexibility that the OTA allows should permit Basilea to progress the pipeline on a more expeditious basis. Initially, BARDA will provide $29m towards the development of BAL2062 and fosmanogepix, reflecting the current shape and priorities in the company's pipeline. We have previously assumed that the cost of the Phase 3 programme for fosmanogepix is likely to be in the region of $140m, given the size and scope of the invasive fungal infections and candidiasis trials. Basilea has suggested that the OTA will cover approximately 60% of the costs of developing its current antifungal pipeline.

Given the larger commercial opportunity associated with the treatment of fungal diseases, we suspect that the future shape of the Basilea anti-infectives portfolio will continue to be dominated by the antifungal franchise. Undoubtedly, the introduction of a list of critical fungal infections by the WHO should stimulate interest, and Basilea stands to be a major beneficiary.

Based on successful Phase 2 results, we look forward to the completion of the Phase 3 programme for fosmanogepix with enrolment now underway. The attraction of BARDA funding reflects the importance of fosmanogepix, the need for novel antifungals targeting critical fungal infections, and the emergence of resistance to currently available antifungal classes. Fosmanogepix promises not only to continue the existing antifungal franchise dominated by targeting invasive fungal infections (particularly invasive aspergillosis in the near term) but should also extend the franchise into the treatment of candidiasis – a rapidly growing fungal threat leading to our peak sales forecast of $1.2bn.

Our forecasts continue to assume that Cresemba sales will start to decline in both the US and Europe after the expiry of exclusivity in Q4 2027. Key to the longer-term outlook for Cresemba will be recent launches in important markets such as China and Japan, which represent substantial opportunities at about 22% of the overall global market. Both oral and IV preparations of Cresemba are now available in China. Although data for China are difficult to find, we note that there are significant growth drivers, including a marked increase in organ transplantation (particularly lung) in China in the recent past.

With the fosmanogepix Phase 3 programme only now underway, it cannot compensate for Cresemba's lost sales in 2028F. However, we should have the Phase 3 data, which will provide further clarity on the long-term outlook for the anti-infectives franchise at Basilea. In the interim, we expect that ceftobiprole's forthcoming US launch should help offset some of the predicted decline in Cresemba sales in 2028F, although we are not anticipating a launch before 2025F. Our peak sales forecast of $400m is based principally on the SAB indication and the company securing a commercial partner with relevant expertise.

We have previously acknowledged that attracting a suitable commercial partner represents another important de-risking event for the Basilea investment case. Our financial model assumes that Basilea eschews the attraction of a substantial upfront payment and has assumed a participation of 25%+ in net sales should be attainable at this late stage in the development of ceftobiprole.

With Phase 3 trials still to be conducted, we have risk-adjusted fosmanogepix sales with a probability of success of 75%. We have also intimated that fosmanogepix may be used on a compassionate use/named patient basis and from an expanded access programme before approval. However, we have not included any contribution from this source at this stage. As we have intimated above, we believe that the activity of fosmanogepix, along with the global Phase 3 programme, suggests that fosmanogepix will enter markets outside of the US and Europe on a timelier basis than Cresemba.

Our forecasts include new guidance for 2024F (post the OTA). As a result, our forecasts now reflect a period of substantial positive cash flow and sustainable profitability. Given the scale of operating loss carryforwards, we do not anticipate tax payments for the next several years. The addition of the BARDA funding now offsets a significant portion of R&D spend and will be received through other revenue. There are still several variables to consider, particularly whether programmes, such as tonabacase or BAL2062, progress into later-stage evaluation. For now, however, we have not included sales from either programme and suspect they are beyond our forecast time horizon in any case. Also, the timing of future milestone commitments as part of the fosmanogepix in-licensing has yet to be detailed. However, Basilea has been adept at managing costs while aggressively pursuing the creation of a world-leading anti-infective franchise.

We look forward to more of the same as the expanded pipeline progresses.

With our forecast revisions, our DCF-derived fair value increases to CHF120 per share.

Basilea Income Statement (CHF' 000)

Source: Calvine Partners Research

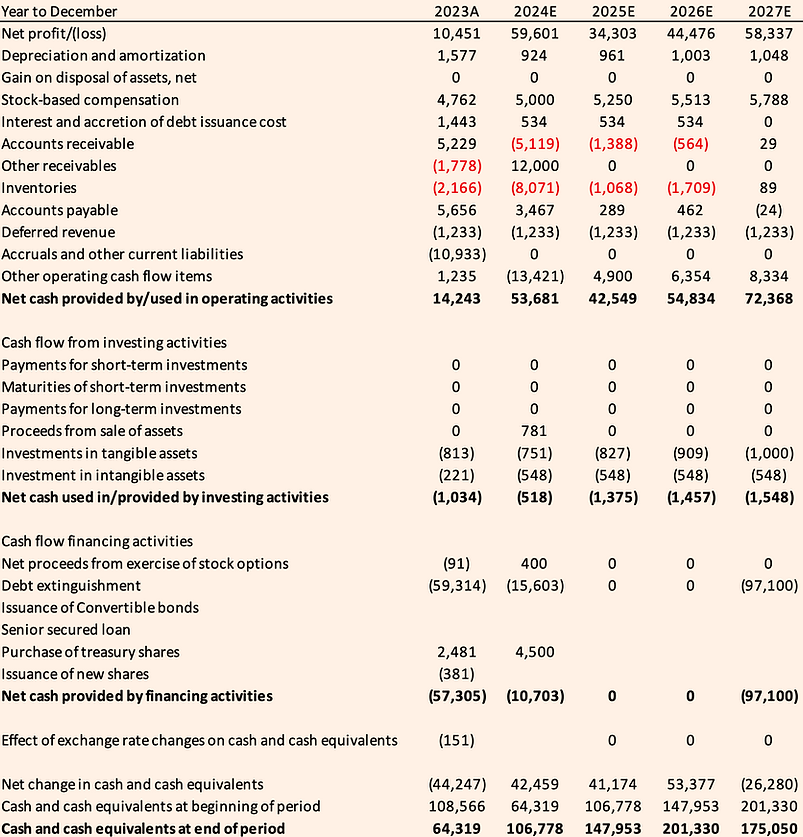

Basilea Cash Flow Statement (CHF' 000)

Source: Calvine Partners Research

Basilea Balance Sheet (CHF' 000)

Source: Calvine Partners Research

Disclosures

Calvine Partners LLP is authorised and regulated by the Financial Conduct Authority for UK investment advisory and arranging activities.

This publication has been commissioned and paid for by Basilea Pharmaceutica and as defined by the FCA is not independent research. This report is considered a marketing communication under FCA Rules. It has not been prepared under the laws and requirements established to promote the independence of investment research. It is not subject to any prohibition on dealing ahead of the dissemination of investment research. This information is widely available to the public.

This report in the United Kingdom is directed at investment professionals, certified high net worth individuals, high net worth entities, self-certified sophisticated investors, and eligible counterparties as defined by the Financial Services and Markets Act 2000 (Financial Promotion) Order 2000. The report may also be distributed and made available to persons to whom Calvine Partners is lawfully permitted. This publication is not intended for use by any individual or entity in any jurisdiction or country where that use would breach law or regulations or which would subject Calvine Partners or its affiliates to any registration requirement within such jurisdiction or country.

Calvine Partners may provide, or seek to provide, services to other companies mentioned in this report. Partners, employees, or related parties may hold positions in the companies mentioned in the report subject to Calvine Partners' personal account dealing rules.

Calvine Partners has only used publicly available information believed to be reliable at the time of this publication and made best efforts to ensure that the facts and opinions stated are fair, accurate, timely and complete at the publication date. However, Calvine Partners provides no guarantee concerning the accuracy or completeness of the report or the information or opinions within. This publication is not intended to be an investment recommendation, personal or otherwise, and it is not intended to be advice and should not be treated in any way as such. Any valuation estimates, such as those derived from a discounted cash flow, price multiple, or peer group comparison, do not represent estimates or forecasts of a future company share price. In no circumstances should the report be relied on or acted upon by non-qualified individuals. Personal or otherwise, it is not intended to be advice and should not be relied on in any way as such.

Forward-looking statements, information, estimates and assumptions contained in this report are not yet known, and uncertainties may cause the actual results, performance or achievements to be significantly different from expectations.

This report does not constitute an offer, invitation or inducement to engage in a purchase or sale of any securities in the companies mentioned. The information provided is for educational purposes only and this publication should not be relied upon when making any investment decision or entering any commercial contract. Past performance of any security mentioned is not a reliable indicator of future results and readers should seek appropriate, independent advice before acting on any of the information contained herein. This report should not be considered as investment advice, and Calvine Partners will not be liable for any losses, costs or damages arising from the use of this report. The information provided in this report should not be considered in any circumstances as personalised advice.

Calvine Partners LLP, its affiliates, officers or employees, do not accept any liability or responsibility with regard to the information in this publication. None of the information or opinions in this publication has been independently verified. Information and opinions are subject to change after the publication of this report, possibly rendering them inaccurate and/or incomplete.

Any unauthorised copying, alteration, distribution, transmission, performance, or display, of this report, is prohibited.