Basilea's decision to partner its infectious disease assets has proven to be highly beneficial, delivering a growing royalty stream. Increasingly, this has allowed the company to fund the novel oncology pipeline. Basilea's cancer franchise is dominated by its lead programme targeting FGFR driven tumours with the FGFR inhibitor derazantinib. Data so far have been encouraging and supportive in the fast to market indication of biliary cancer. Data suggest a differentiated profile and the potential to provide additional activity to the popular checkpoint inhibitor class of immunotherapy. The lead indication here is urothelial cancer (FIDES-02) where the checkpoint inhibitors have limited activity. A gastric cancer study has also been recently initiated (FIDES-03). Should FIDES-02 be successful, derazantinib could help transform the treatment of patients with urothelial cancer.

Oncology programmes front and centre stage

The oncology pipeline is progressing at Basilea with derazantinib following a fast-to-market approach in iCCA. Derazantinib should be a lower risk endeavour, with FGFR inhibitors well-proven, encouraging proof of concept, as well as interim Phase 2 data. We anticipate topline data in H2 2020 in iCCA and in patients with FGFR2 fusions, which should flesh out its profile here. More importantly, derazantinib appears to possess properties (CSF1R inhibition), which suggest additional activity, differentiating it from other FGFR inhibitors. Basilea is investigating the potential for this activity to boost the efficacy of the popular checkpoint inhibitors in relevant cancer settings. Derazantinib is initially being explored in urothelial cancer as monotherapy, and also in combination with Tecentriq (atezolizumab). History with FGFR inhibitors suggests positive activity as monotherapy while FDA labelling restrictions have constrained checkpoint inhibitor use. Gastric cancer was recently added to the list of target indications for the combination. Next up, lisavanbulin represents a novel tumour checkpoint controller that does not suffer from resistance issues with other microtubule targeting agents. Importantly, it can cross the blood-brain barrier and has delivered "profound responses" in a subset of glioblastoma patients. With the potential of a biomarker to identify suitable patients, lisavanbulin has entered a Phase 2 study in glioblastoma.

The anti-infective portfolio is still important

Basilea's antifungal Cresemba dominates product sales. While the spectre of a post-antibiotic era is already well recognized, the threat of increasing resistance to invasive fungal infections is arguably less well recognized but more concerning given the lack of existing products and a barren pipeline. Cresemba enjoys an extended-spectrum and a differentiated safety profile with optimal partners Astellas (US) and Pfizer (EU, APAC & China). The US remains the key market for fifth-generation cephalosporin ceftobiprole, and the bacteraemia indication is the key. Prior data suggest grounds for confidence. Our DCF suggests an NPV of CHF120 (See Risk section).

Cancer franchise growing in importance

With the main anti-infectives product (Cresemba) in the hands of commercial partners, Zevtera/Mabelio selling in various geographies (ex US) as well as progressing through Important Phase 3 trials in the US funded mainly by BARDA, Basilea is now well-positioned to advance its expanding oncology interests. Derazantinib represents a differentiated participant from the now clinically validated FGFR class of anti-cancer agents. Derazantinib is following a fast-to-market approach in its lead indication of biliary cancer. Positive interim data in a modest number of patients treated allows us to look forward to the topline data after completion of enrolment in iCCA patients with FGFR2 fusions in H2 2020. Positive data, with a competitive profile, should allow derazantinib to compete initially in a modest market opportunity. The market potential will be considerably enlarged as broad applicability of the FGFR class becomes increasingly appreciated, and there are multiple cancer settings which may prove tractable to such an approach.

The FGFR class is becoming more competitive, with others ahead of derazantinib in the two lead indications of biliary cancer (iCCA) and urothelial cancer. However, the prospects for derazantinib are linked to its ability to boost the effectiveness of checkpoint inhibitors, particularly in those indications where activity in monotherapy is lacking (e.g. urothelial cancer). Although this may seem a high-risk endeavour, there are several reasons to believe that the result should be supportive; this includes the observation that 25% of patients in the successful Balversa pivotal study in urothelial cancer had previously received checkpoint inhibitor therapy.

Lisavanbulin provides Basilea with a novel checkpoint controller offering a much-improved resistance profile to other widely used microtubule targeting agents (MTAs), as well as good oral bioavailability. These are early days for lisavanbulin, and clinical data is relatively sparse. However, the lead indication of glioblastoma is an unmet need, and lisavanbulin generated substantial and "profound" objective responses in two patients in early-stage trials. Notably, there appears to be a subset of patients that benefits and can be identified using a novel biomarker which is predictive of lisavanbulin response. This allows Basilea to follow a more precise targeted approach to patient selection for the forthcoming Phase 2 glioblastoma trial.

Outside the clinical-stage programmes, Basilea has several preclinical programmes where we expect greater detail to

emerge as they approach the clinic. In particular, we note that there is some potential interest, amongst others (suppression of malignant code), in the increasingly important DNA damage repair response (DDR). DDR is a particularly exciting area with several novel targets under investigation elsewhere. Success here for Basilea could significantly increase the profile of the company's oncology efforts.

Anti-infectives still core

Sales of Basilea's antifungal Cresemba (isavuconazole) have been better than initial expectations thanks to its extended spectrum, good safety profile and also the excellent existing franchises of key commercial partners Astellas and Pfizer. Sales through distributors have also helped deliver impressive growth in the overall isavuconazole franchise

Basilea has enjoyed considerable success with Cresemba, which is approved for the treatment of invasive mould infections. The importance of new antifungal classes has largely been overlooked with few new classes evident. There is a small number of antifungal classes, an increasing problem of resistance to existing agents, a rising population of immunosuppressed patients and the associated high mortality rate. There may be a lack of government initiatives to encourage the development of new antifungals (compared to antibiotics). Still, the pharmaceutical industry has been more enthusiastic, reflected in the partnerships secured by Basilea.

Indeed, we believe that the commercial potential of Cresemba (isavuconazole) has been reflected in the attraction of highly appropriate partners in Astellas (US) and Pfizer (EU, APAC & China). Basilea’s partnering activities have led to considerable success ensuring that its key products are widely available geographically and on highly lucrative commercial terms.

With requisite partners in place and clinical experience with Cresemba growing, we look forward to evolving guidelines better reflecting the differentiated nature of isavuconazole

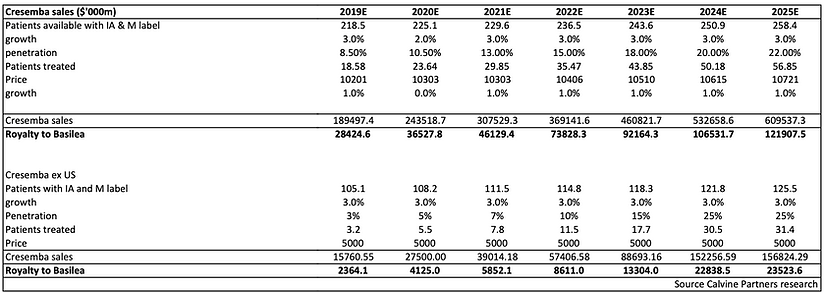

compared to existing agents, particularly in the US. Our forecasts suggest that the peak in-market sales of Cresemba globally, in the invasive aspergillosis and mucormycosis indications, should be over $500m by 2025E.

Although approved in Europe and other territories (ex US), the path to success for ceftobiprole, a fifth-generation cephalosporin antibiotic, has been chequered. Despite positive results, early development in the US and Europe through partner J&J in ABSSSI was undermined by data integrity issues. Nevertheless, all has not been lost with the GAIN Act and QIDP designation providing ten years (5+5) of exclusivity in the key US market post approval. Combined with financial support from the US Government's BARDA, and a focus on the unmet medical need of Staphylococcus aureus bacteraemia, there is a significant market opportunity for ceftobiprole. We are forecasting unrisked peak sales of CHF250m in SAB, and believe that success here will facilitate an appropriate partner for the US market.

While we believe that the bacteraemia indication represents the most important opportunity for ceftobiprole, the ABSSSI indication is large, despite a competitive environment. Even a relatively modest market share could be significant. The positive outcome of TARGET (the completed Phase 3 ABSSSI study) has confirmed the activity of ceftobiprole, but it is important to remember that a positive result is required in both pivotal trials for FDA approval.

Source: Company reports

Basilea's Pipeline

Source: Company Reports

The pipeline of novel cancer therapies is progressing

In addition to its growing in-house efforts, Basilea turned to the in-licensing route to accelerate its presence. The in-licensing of derazantinib (formerly ARQ 087) added a clinical late-stage oncology asset for a reasonably modest upfront fee of $10m. Derazantinib is a novel fibroblast growth factor receptor inhibitor which had previously generated positive Phase 1/2 data in the treatment of biliary cancer.

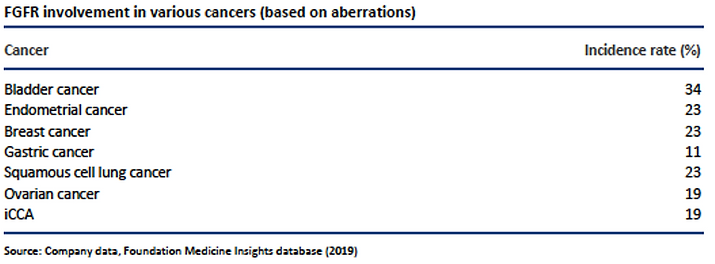

Fibroblast growth factors, along with their receptors (FGFR1-4), are implicated in key aspects of cell regulation including proliferation, differentiation, migration and survival through interaction with multiple signal transduction pathways (MAPK, PI3K, PLC and STAT). Consequently, their dysfunction/activation has been implicated in a broad range of cancers which include most of the challenging cancers, including bladder, biliary, gastric, breast, ovarian and endometrial cancers.

The immediate focus for derazantinib has been the Orphan disorder intrahepatic cholangiocarcinoma (iCCA). Most patients (85%) present with unresectable (inoperable) disease with the result that treatment options usually involve efforts to reduce the size of the tumour to enable resection. Of patients with cholangiocarcinoma (CCA), FGFR2 alterations (fusions, mutations or amplifications) are found almost exclusively in iCCA; hence it would appear to be an indication with a high likelihood of success.

iCCA is relatively rare in the developed world, with an incidence of between one and two per 100000 whereas in Asia it is higher. In China, the rate is 10 per 100000, and in Taiwan 40 per 100000. Originator Arqule previously licensed rights to China, Hong Kong, Macau and Taiwan to Roivant Sciences while Basilea has secured rights outside these territories. Using the incidence numbers above suggests circa 3000 and 6000 patients in the key US market, implying that this is an ultra-orphan indication which should provide significant pricing flexibility. This pricing is reflected in the cost per treatment cycle of $17000 in the US for Pemazyre.

Derazantinib is initially targeting the 10-20% of the iCCA population that suffers from a FGFR2 gene fusion. This highly specific targeting approach has already delivered improved response rates for these novel FGFR inhbitors compared with previous generations of kinase inhibitors such as Stivarga (regorafenib), Iclusig (ponatinib), Votrient (pazopanib) and Lenvima (lenvatinib). Indeed, it is highly likely that optimizing the clinical benefit of FGFR-targeting drugs will be dependent on the selection of appropriate patient populations.

Basilea in-licensed derazantinib in 2018 following the publication of positive proof of concept data with Orphan Drug Designation granted in the US and Europe.

While we await the outcome of the Phase 2 registrational study in H2 2020, it is worthwhile recapitulating on the data from the proof of concept study. Although the primary endpoint may have focussed on safety and tolerability, secondary and exploratory endpoints provided important information on anti-tumour activity as well as the association between biomarker activity and target inhibition. Data were presented at ASCO 2017, achieving an overall response rate (ORR) of 21% and a disease control rate of 83%. Clinical benefit was seen in 72% of patients.

Phase 1/2 - Best Overall Response in Evaluable Population

Source: ASCO 2017

Source: ASCO 2017

Additionally, positive data were presented with respect to the durability of the response and in comparison with traditional chemotherapy (based on intrapatient data in FGFR2 fusion positive patients). These data suggest potential use in the first-line setting.

Derazantanib - Proof of Concept Data

Source: Company data

Source: Company data

Basilea reported a post-hoc analysis from the Phase 1/2 study from 44 patients with locally advanced, inoperable or metastatic iCCA, with either FGFR2 gene fusions, mutations or amplifications, (or no FGFR2 genetic aberrations). Overall, the disease control rate (DCR) for patients with alternative genetic aberrations (mutation or amplifications) was 67% compared to 83% for gene fusions, with median progression-free survival (PFS) for fusions lasting 5.7 months vs 6.7 months for alternative aberrations. The duration of disease control was similar at 8.1 months vs 8.6 months for fusions vs alternative mutations respectively. There was no benefit in patients without FGFR2 genetic aberration, fleshing out the efficacy profile of derazantinib. While this is a post hoc analysis, it provides a strong insight into the likely result in the ongoing Phase 2 study.

A registrational Phase 2 trial in iCCA patients is currently underway in the US, Canada and Europe. Around 100 second-line patients are being investigated in a biomarker-driven study (identifying FGFR2 fusions). Results are expected in H2 2020. An interim analysis provided encouraging evidence of activity in FGFR driven tumours, with an ORR of 21%, and a manageable safety profile consistent with its mechanism of action. Furthermore, the disease control rate, reflecting the proportion of patients with a partial response or with stable disease, was 83%. When combined with the proof of concept (PoC) data, which showed that treatment with derazantinib was associated with substantially longer duration on therapy than on prior second-line chemotherapy, we remain confident that the full data readout due later in 2020 should support a regulatory filing. It should also be noted that the interim readout did not represent the full maturity of the data, and more responses may occur after the interim analysis.

The positive nature of the data delivered to date confirms the merits in the fast to market approach. While the initial indication may be modest, we believe that the combination of observed efficacy along with acceptable tolerability/ toxicity bodes well for development extension into larger FGFR2 driven cancers where the real opportunity for derazantinib lies.

Broadening the applicability of derazantinib

As noted above, iCCA represents a modest, but needy, market opportunity for the FGFR inhibitors. However, it is essential to remember that this represents a fast-to-market approach. Indeed, our expectation is that the regulatory strategy will be confirmed after receipt of the full dataset.

Fibroblast growth factors (FGFR1-4) are implicated in critical aspects of cell regulation, including proliferation, differentiation, migration and survival through interaction with multiple signal transduction pathways. As a result, their dysfunction/ activation has been implicated in a broad range of cancers which include most of the challenging types including bladder, biliary, gastric, breast, ovarian and endometrial.

Derazantinib is a potent inhibitor of FGFR1-3 with a clear potential beyond the initial proof of concept iCCA indication. Indeed, even within iCCA, we note that Basilea has already expanded FIDES-01 to include additional FGFR alterations (cohort 2) as well as the FGFR2 fusion patient population (cohort 1). This expansion is based on the positive post hoc analysis of the previous proof of concept study, which showed that it was not only patients with FGFR fusions which benefited from derazantinib.

Additionally, Basilea is conducting preclinical translational evaluation of derazantinib to ensure that future development targets the most appropriate cancer type. Ultimately, there are several FGFR tumours of significant potential worthy of development efforts from Basilea.

Differentiating derazantinib in an increasingly competitive environment

The competitive environment for the next generation of FGFR inhibitors is intensifying, and this validates the scientific approach. In April 2020, Incyte's Pemazyre (pemigatinib), an FGFR1-3 inhibitor, received accelerated approval in the metastatic cholangiocarcinoma indication. Pemazyre is for patients with an FGFR2 fusion, or other rearrangement, after identification by an FDA-approved test. The conditional approval was based on the results from the FIGHT-202 open-label study. In FIGHT-202, from 146 patients enrolled, 107 were identified as having an FGFR2 alteration (cohort A). Of these, 92 had FGFR2 gene fusions, and 15 had FGFR2 rearrangements. Of the remainder, 20 had other FGFR alterations while 18 had no FGFR change. In those with FGFR2 alterations (cohort A), the ORR was 35.5% (95% CI: 26.5%, 45.35%), with 3 complete responses and 35 partial responses. The median duration of response was 9.1 months, with responses lasting ≥ six months in 24 of the 38 responding patients and ≥ 12 months in 7 patients. The median PFS was 6.9 months (6.2-9.6) while overall survival (OS) data were not mature.

While it is inevitable that the 35.5% ORR compares well with derazantinib's observed 21%, we would caution that cross-trial comparisons of single-arm studies have significant limitations, including confounding factors. Additionally, we have yet to see the full readout from the ongoing FIDES-01 study. Nevertheless, we view the approval of pemigatinib as a major de-risking event for the FGFR inhibitor class in the iCCA setting.

Looking to the wider potential for the FGFR class, and Incyte's broad programme in various tumour types, it is helpful to note that, pemigatinib is undergoing a relatively comprehensive Phase 2 programme in monotherapy. The FIGHT programme includes patients with metastatic or unresectable bladder cancer (FIGHT-201) and patients with myeloproliferative tumours that have activating FGFR-1 mutations. Incyte is also evaluating pemigatinib in the iCCA population as a potential first-line therapy in newly diagnosed patients with activating FGFR2 translocations. The Phase 3 FIGHT-302 study has recently been initiated targeting 432 patients in a first-line setting, expecting to conclude in March 2022 (primary completion).

Janssen's Balversa (erdafitinib) represented the first approval of a targeted FGFR inhibitor following its accelerated approval (April 2019) in second-line (metastatic or locally advanced) urothelial cancer with susceptible FGFR3 mutations or FGFR2/3 mutations. Importantly, from Basilea's perspective, 25% of patients had previously received treatment with a checkpoint inhibitor (PD-1/PD-L1). Balversa benefited from Breakthrough Therapy designation and was approved based on an ORR of 32.2%. Erdafitinib has also been evaluated in iCCA, with data presented at ESMO 2018. The small (n=12) Phase 2a PoC study and generated an ORR of 66.7% in those harbouring an FGFR2 alteration. While these are small numbers, and larger studies are required, we believe that these data in their totality across all of the different FGFR inhibitors, validate the approach in FGFR driven cancers.

For its own part, Basilea has highlighted the different properties and pharmacology of each of the different FGFR inhibitors. Unsurprisingly perhaps, there are differences in kinase inhibition profiles between the various molecules and the toxicity profiles also vary. Consequently, despite the apparent lead-time advantage for pemigatinib in iCCA, management remain confident that derazantinib can be positioned to best serve the most appropriate patient populations.

Irrespective of the competitive environment, the prospects for second-generation targeted FGFR inhibitors remain healthy. There are numerous indications, both in monotherapy and in combination with immunotherapies and older chemotherapies, offering significant market opportunities. For Basilea, assuming a successful fast to market approach in iCCA, the key to commercialization will be ensuring that adequate resource is deployed behind indications that are best suited to the properties of derazantinib.

As a further example of this, Basilea previously expanded the ongoing iCCA study to include additional FGFR mutations as well as FGFR2 fusion mutations. Success here would be another important differentiating feature for derazantinib versus other FGFR inhibitors. Data are also anticipated from these patients later in 2020. These data will clearly be important with respect to evaluating the ultimate scope and market potential of derazantinib.

Our sense is that we are still at the beginning of understanding the full market potential of derazantinib noting that it is a potent inhibitor of FGFR1-3. Competition is certainly afoot although there may be nuanced differences in activity based on receptor selectivity. Indeed as we have noted elsewhere there is substantial competition with other programmes leading in the initial indications of iCCA and urothelial cancer. For example, there are several programmes targeting FGFR which have followed different approaches based on selectivity to FGFR kinases with infigratinib and pemigatinib inhibiting FGFR1-3 with erdafitinib and ponatanib targeting FGFR1-4. Clearly, should further efforts to evaluate the potential of derazantinib in other indications prove successful, the potential market opportunity for this approach could be significant.

Interaction with CSF1R an important differentiator

Basilea has sought to explore the potential of derazantinib in combination with the checkpoint (PD-L1) inhibitor Tecentriq (atezolizumab). The intention here is to exploit the potential for derazantinib to block colony-stimulating-factor-1 receptor (CSF1R) as well as FGFR. Given the varying properties of the FGFR inhibitors, blocking CSF1R appears to be a differentiating feature. In this regard, Basilea has entered into a clinical supply agreement with Roche with respect to exploring the combination in urothelial and gastric cancer.

The combination appears to be relevant to re-programming tumour-associated macrophages (TAMs). TAMs are important in that they appear to be tumour inducing and are involved in disease progression through various processes. These include the proliferation, invasion and metastasis of tumour cells as well as preventing T cell-mediated anti-tumour responses. Successful intervention here should be beneficial in limiting tumour growth and progression.

Mechanism of action of CSF/PD-L1 and TAMs

Source: A. Ghasemzadeh et al

Given the checkpoint inhibitors' mechanism of action, the combination of derazantinib with Tecentriq should provide a synergistic effect. Basilea has followed the science in its approach to derazantinib development opting to target patients with bladder (urothelial) cancer. While 15-20% of muscle-invasive urothelial cancer patients suffer from an FGFR mutation, response to immunotherapy has been lacklustre in this largely elderly patient population.

Despite the initial approvals of Tecentriq and Keytruda, the FDA updated the label, limiting the use of both agents. The label update followed the observation of decreased survival in patients receiving monotherapy when compared to standard (platinum-based) chemotherapy. Given the high response rates (ORR~35%) in urothelial cancer patients receiving FGFR inhibitor therapy (reflected in the approval of Balversa), the combination with a checkpoint inhibitor would appear to be a potentially transformational approach to the treatment of urothelial cancer; particularly the case with those who are ineligible for platinum-based treatment.

Basilea has designed the FIDES-02 Phase 1/2 study to recruit patients who are cisplatin-ineligible or who have failed on first-line therapy (or prior treatment with FGFR inhibitors). The trial comprises four open-label studies in advanced urothelial cancer patients along with an FGFR gene alteration, comparing the activity of derazantinib alone or in combination with the Tecentriq. The primary endpoint completion date is 2022. Late-breaking abstracts, presented at the AACR-NCI-EORTC conference in Boston, suggest that derazantinib has equipotent activity against CSF1R as well as FGFR 1, 2 &3. The data underpin the prospect of increasing the susceptibility of the tumour microenvironment to immunotherapy and potentially helping to de-risk the ongoing FIDES-02 study.

Additionally, given the high response rates in urothelial cancer patients receiving FGFR inhibitors (ORR 35%), the combination with a checkpoint inhibitor would appear to be a potentially transformational approach. Reassuringly, 25% of patients in the Balversa study had also received a checkpoint inhibitor. We believe that positive results from FIDES-02 would position Basilea at the forefront of such an endeavour.

Lisavanbulin showing promise in a challenging cancer setting

The microtubule targeting agents (MTAs) have been the mainstay of chemotherapy for many decades. The vinca alkaloids (microtubule de-stabilizing agents including colchicine) and taxanes (microtubule stabilizing agents) are highly potent in multiple cancer types. Despite the introduction of targeted therapies, microtubule agents remain first-line therapy for many cancers. Given that microtubules perform several important roles in cell division (mitosis) and migration, it is unsurprising that they have proven to be fruitful targets for cancer chemotherapy. In dividing cells during mitosis, the microtubules forming the mitotic spindle ensure that genetic material is shared equally between dividing cells and have proven to be very tractable to therapeutic intervention. With many microtubule therapies derived from natural sources, development of newer microtubule agents has been relatively protracted.

While MTAs have proven to be highly effective in multiple solid and haematological cancers, side effects associated with their long and short term use have limited their applicability and use. DNA damage and apoptosis are the main causes of drug-induced cytotoxicity, while neurological and haematological side effects are dose-limiting toxicities. There are also other challenges which include poor solubility and cumbersome synthesis/ manufacture.

One of the most significant factors limiting the applicability of microtubule inhibitors has been the development of rapid resistance. Multiple mechanisms of drug resistance have been characterized, which typically involve efflux mechanisms and membrane-associated changes to prevent drug accumulation within tumour cells. Both taxanes and vinca alkaloids are substrates of the (P-gp) efflux pump and represent the primary resistance mechanism. Tubulin variants (isotypes) are also involved in the induction of resistance.

Basilea's focus has been to overcome these resistance issues. We note that lisavanbulin (formerly BAL101553), a (highly soluble) prodrug of BAL27862 retains its potency in human tumour models which are resistant to archetypal MTAs including the taxanes and the vinca alkaloids. BAL27862 binds to the colchicine site with distinct effects on microtubule organisation - it is an extremely potent inhibitor of tumour growth and a promoter of cell death.

As a small molecule, one of the key features of lisavanbulin is it can cross the blood-brain barrier - unlike many commercially available MTAs which are natural compounds. The successful discovery and development of a small molecule inhibitor is no mean feat given that replicating the activity of natural compounds involves complex chemistry. Success here is a testament to the capability of the medicinal chemistry expertise and the in-depth understanding of tumour biology. Intriguingly, lisavanbulin appears to possess a dual mechanism of action inhibiting not only growth and viability of the tumour but also the vasculature feeding the tumour.

Basilea has been evaluating lisavanbulin in a broad range of cancer types both in monotherapy as well as in combination, reflecting the applicability of the approach. With encouraging evidence of activity seen in solid tumours, the focus has been on the challenging glioblastoma indication. Glioblastoma multiforme is the most common malignant glioma, characterised by highly aggressive growth – its highly invasive nature accounting for the poor overall survival in sufferers. Post resection, current standard of care consists of radio-chemotherapy and concomitant temozolomide. Temozolomide is a DNA alkylating agent discovered in the 1970s and approved by the FDA in 2005 to treat newly diagnosed brain cancer. However, treatment provides a disappointing median survival period of only 14.6 months, and new therapeutic approaches are urgently required. Development of novel therapies for glioblastoma has been disappointing. It will be interesting to see if Basilea's biomarker-based approach can successfully identify suitable patients. The generally received wisdom holds that the heterogeneity of the tumour itself has prevented successful drug development.

While our enthusiasm for lisavanbulin must be guarded given the early stage of development and the limited data generated, we are highly encouraged by the data from the Phase 1 programme. Phase 1 evaluated both oral and IV administrations in glioblastoma patients (less so in ovarian cancer). In particular, we note the commentary surrounding two patients who experienced "profound" responses which were characterised as an 80% reduction in tumour size.

One of the more intriguing aspects of the lisavanbulin data is its association with a potential biomarker EB1. The literature is supportive of such an approach given the importance of EB1 (along with its binding partners) in microtubule regulation. Therefore, there are good reasons to believe EB1 expression levels in glioblastoma are a predictive biomarker of MTA activity. From Basilea's perspective, the preclinical data incorporating EB1 appears strong, and in the clinic, one EB1 (highly) positive patient experienced a strong and durable response to lisavanbulin. The patient remains on therapy. The relevance of EB1 is important here since it enables Basilea to enrich the patient population in the upcoming Phase 2 study.

Glioblastoma patients who express EB1 are presumably best placed to benefit from treatment. If EB1 turns out to be a valid biomarker in glioblastoma patients, the clinical development risk should be substantially lowered. This is an attractive proposition given the high failure rate for chemotherapy based approaches in the treatment of glioblastoma.

Basilea's efforts are augmented by the collaboration with the Adult Brain Tumour Consortium (ABTC) who is funded by the US National Cancer Institute. Towards the end of 2017, the ABTC began evaluating lisavanbulin in combination with radiotherapy in newly diagnosed glioblastoma patients.

The data supporting the potential of lisavanbulin in glioblastoma are exciting, although in small numbers. Nevertheless, in a cancer setting where death is inevitable after a relatively short period (<5% after five years), the efficacy hurdle could be low, particularly where improved resistance is a potential benefit. Fortunately, it is a relatively rare cancer causing about 2% of all cancers and 17% of all brain tumours.

It has an incidence of 2-3 per 100,000 in the population, with almost 23,000 newly diagnosed patients per year in the US. Most patients will die within 15 months. Lisavanbulin currently sits outside our Basilea valuation, with not enough positive data to justify inclusion in our financial forecasts. Nevertheless, assuming a price of $15,000 per year, and rapid market penetration of the US, the glioblastoma indication would suggest $250m at peak, five years post-launch.

Although the use of MTAs has been overshadowed in recent years by the enthusiasm for immunotherapy-based approaches, we suspect that their use will remain for those patients where few treatment options exist. Consequently, although we have yet to see plans for lisavanbulin outside glioblastoma, assuming a positive outcome here, we would expect to see further clinical evaluation.

Cresemba remains an important contributor for Basilea

The anti-infectives franchise has been a feature of the Basilea investment case for a considerable length of time. With its sales success, Basilea's novel antifungal Cresemba (isavuconazole) has increased in importance. Additionally, as the oncology pipeline has taken centre stage, management remains positively endeared towards the potential for its anti-infectives franchise. Although Cresemba is now out-licensed or sold through distributors, it is important to review and analyse the various components of this growth story. The dynamics should continue to drive sales and enable Basilea to fund its novel R&D programmes.

Fungal infections are often overlooked but can be highly insidious. They can leave patients with a variety of life-threatening disorders which can be invasive, acute and chronic. The most prevalent invasive fungal pathogens include Candida, Aspergillus and Mucormycetes. Of the invasive fungal diseases, meningitis, fungaemia, and pneumonia are particularly problematic. In the chronic setting, infections such as chronic pulmonary aspergillosis and allergic bronchopulmonary aspergillosis feature heavily.

The vast majority of life-threatening invasive fungal infections affect individuals suffering from a compromised immune function. The need for more effective antifungals has increased proportionately with a rise in HIV infection and other conditions, including primary immunodeficiency, aggressive cancer chemotherapy, and the use of immunosuppressant therapy in organ transplantation. Often these infections are associated with a significant mortality risk particularly because there is no effective immune system to aid antifungal activity. This is particularly an issue if the antifungal agent in question is fungistatic (needing an effective immune system to effect the cure) rather than fungicidal (directly killing the fungus).

Unfortunately, the development of new antifungals has not kept pace with physicians' armamentarium currently limited to only three available classes. These comprise the polyenes, the azoles, and the echinocandins. Given the paucity of available antifungal classes, the emergence of resistance is of even greater concern in antifungals than in antibiotic development, despite receiving significantly less publicity and government attention. Reflecting on HIV treatments, the introduction of new classes such as integrase inhibitors, triple, and dual therapies have turned a life-threatening infection into a chronic disorder. The unintended consequence of these new therapies is that they further fuel the need for antifungal treatment. The use of aggressive chemotherapy regimens, particularly as they relate to haematological cancers, has also been a significant driver of invasive fungal infections.

The outlook for patients with invasive fungal infections is far from reassuring. Mould infections are particularly problematic in the immunocompromised patient population and represent a significant source of morbidity and mortality. For aspergillosis, for example, the mortality rate varies from 34% to up to 58% in high-risk patient populations, being influenced by the site of infection (usually the lung) and the immunocompetent state of the patient. Invasive aspergillosis is characteristically associated with risk factors such as chemotherapy-induced neutropaenia.

Not only is the prognosis for patients with invasive fungal disease poor, but the lack of novel therapies also exposes patients to the risk of resistance to older agents. However, identifying new agents is, unfortunately, far from straightforward with a multitude of biological and biochemical processes conserved between humans and fungi. As a result, any attempt to target these shared pathways often results in unacceptable toxicities in humans, irrespective of the efficacy against damaging fungal infections. It is of little surprise that each of the three existing antifungal classes has come from targeting structures that are unique to fungi.

Current antifungal agents for the treatment of invasive fungal infections in humans include the polyenes, azoles, echinocandins, and pyrimidine analogues. All of these drug classes have disadvantages that can limit their use in clinical practice. The echinocandins, for example, have poor bioavailability and can only be dosed by injection. In general, the echinocandins are used for salvage therapy and in combination. The polyenes (such as amphotericin B) suffer from limited efficacy and substantial toxicities (acute renal failure) in high-risk patients, leading to the successful introduction of lipid formulations. Additionally, antifungal resistance to polyene therapy is common in Aspergillus.

The azoles, on the other hand, represent the most widely used class of antifungals. Azoles exert their action by inhibiting the C14 demethylation of lanosterol leading to the inhibition of ergosterol production in the cell membrane. Ergosterol is a major component of fungal membranes which regulates membrane fluidity and permeability, and is required for fungal growth. The inhibition of ergosterol produces methylated sterols in the fungal membrane, altering its function and allowing the accumulation of ergosterol toxic precursors in the cytoplasm, and leading to cell death. However, azoles' broad use has resulted in widespread resistance with its emergence developing by various mechanisms. These include overexpression of CYP51 or by mechanisms which effectively reduce the intracellular presence of antifungal compounds (such as ATP-binding cassette transporters).

Major advantages of the second-generation triazoles, posaconazole and voriconazole, include their extended antifungal spectrum and availability in both oral and intravenous formulations. However, the use of these agents is often limited by their variable bioavailability, severe adverse events, significant drug–drug interactions, and the emergence of resistance. Posaconazole use, for example, is limited in the US to prophylaxis of mould infections. Isavuconazole is a relatively new triazole possessing an extended spectrum with activity against yeasts, moulds, and dimorphic fungi. It also possesses an excellent safety profile which, combined with helpful pharmacokinetic properties, are highly suggestive of an important role in the treatment of various serious and life-threatening fungal infections.

The extended spectrum of Cresemba is extremely important and related to its significant commercial potential. Isavuconazole inhibits cytochrome P450 (CYP51) dependent 14α-lanosterol demethylation, and the side arm of the active isavuconazole molecule allows greater avidity for the binding pocket in the fungal CYP51 protein. This protein is responsible for the broader antifungal spectrum, which includes infections resistant to other azole-based therapies. Also of importance to its commercial allure is the excellent tissue distribution, oral bioavailability, safety profile and highly predictable pharmacokinetics, with little interpatient variability.

Cresemba has been approved in the US for the treatment of invasive aspergillosis (IA) having been shown to be non-inferior to voriconazole. It has also been approved by the FDA for the treatment of invasive mucormycosis. Cresemba is also approved in the EU (and other countries) for the treatment of adult patients with invasive aspergilosis and for the treatment of adult patients with mucormycosis for whom amphotericin B is inappropriate. Unfortunately, the role of the echinocandins as first-line treatment for invasive candidiasis was re-enforced with the negative result from the ACTIVE Phase 3 study where isavuconazole failed to show non-inferiority to caspofungin. This result was perhaps unsurprising given that anidulafungin was found to be superior to fluconazole.

Invasive aspergillosis is a life-threatening disorder with a high mortality rate. IA can result in hospitalization of up to one month and represents the major opportunity for Cresemba. Mucormycosis may be rarer, but its prevalence is increasing rapidly, and it is acknowledged to result in unacceptable morbidity and mortality (90-100% in neutropenic patients and disseminated infection). Mucormycosis results in a burden to the US healthcare system of circa $100,000 per patient.

The current guidelines for the treatment of invasive aspergillosis, issued by the IDSA in December 2016, has voriconazole as the centrepiece of first-line antifungal therapy. The guidelines are supported by a high level of evidence in the pulmonary aspergillosis setting in particular. Isavuconazole was given a relatively limited position within the guidelines as an alternative to voriconazole. Admittedly, the guidelines profess to "…begin to define the place in therapy for isavuconazole". There are, however, some important advantages offered by isavuconazole which include a broader spectrum compared to voriconazole, more consistent plasma levels and fewer drug related and treatment-emergent adverse events. Overall, isavuconazole possesses a more benign tolerability profile with no requirement for a cyclodextrin based solubility agent (important in renally impaired patients), a once-daily dosing, and a more limited drug interaction profile.

In Europe, the European Conference on Infections in Leukaemia (ECIL) has provided recommendations for the targeted treatment of candidiasis, aspergillosis and mucormycosis. The latest ECIL-6 meeting held in March 2017 reported that isavuconazole appeared to be as effective as voriconazole for the treatment of IA, and with a better safety profile. Consequently, it was afforded an impressive AI grading which is the same status as voriconazole.

As clinical experience with Cresemba increases over time, we anticipate that the willingness of physicians to use this differentiated antifungal in the treatment of invasive moulds should increase. This trend will be supported should the relevant guidelines evolve, and provide a greater emphasis on Cresemba's use in earlier lines of treatment.

The importance of a novel antifungal has been endorsed by the attraction of two pharmaceutical heavyweight commercial partners, Astellas and Pfizer. Cresemba represents an important addition to the Astellas antifungal/ anti-infectives franchise, which also contains AmBisome (a liposomal encapsulated formulation of amphotericin B) and Mycamine (an echinocandin). Mycamine's label includes prophylaxis of Candida infections, complementing the labelling of Cresemba. The importance of Cresemba to Astellas was reflected in the commercial agreement struck when Cresemba was still in Phase 3 development. Basilea received CHF75m upfront, up to CHF478m on development and sales milestones, and significant double-digit tiered royalties on sales. The agreement was subsequently amended with Basilea regaining full ex-US rights with total sales-based milestones amounting to $285m (after having already received $42m of regulatory and $5m of sales milestones) while maintaining the double-digit tiered royalties on US sales.

Outside of the US, Basilea attracted Pfizer as a commercial partner for Cresemba, firstly for Europe (in June 2017) and then for Asia Pacific (in December 2017). The European license delivered CHF70m in upfront payments while the addition of Asia-Pacific delivered an additonal CHF3m initially. Total potential milestones for the two agreements amount to an impressive CHF650m on unspecified regulatory and sales-related milestones. Of greater importance is the mid-teens royalties on sales which Basilea secured. The addition of Pfizer reflects not just the differentiated clinical profile but also Cresemba's early commercial success in Europe under Basilea's direct marketing efforts.

For Pfizer, the originator of voriconazole (branded as Vfend), adding Cresemba provides an antifungal which can be positioned as an alternative to voriconazole (as per the current guidelines). Cresemba offers a more benign tolerability profile resulting in fewer drug related adverse events (42% vs 60%) with an improvement in measures such as hepatobiliary disorders, skin and eye disorders.

Fortunately, IA is relatively uncommon and mucormycosis even less so. Both are, however, challenging to diagnose which is reflected in the underreporting of these conditions. In its favour, isavuconazole's broad spectrum (including Mucorales) should position it well in the empiric setting, compared to alternative agents (such as voriconazole), where infection is suspected but not confirmed.

Surveillance for both IA and mucormycosis has been limited, and neither are reportable diseases. However, there can be little doubt that both are growing along with an increasing population of immunocompromised patients. Data is hard to identify, and we note various datapoints which highlight the scale of the issue with 10m patients at risk of contracting invasive aspergillosis. Data from US hospital discharge rates suggest a rate of c46 per 1m for invasive aspergillosis and 3.4 for mucormycosis in 2013.

However, the increasing use of aggressive chemotherapy has resulted in a rapidly growing market for antifungal treatments to the extent that we believe that hospital discharge codes are underreporting the size of the market. We note that 80% of the antifungal market resides outside the US, with 70000 patients in Europe dying from IA. By extrapolation, assuming an IA mortality rate of 41% in solid organ transplant patients and 75% in stem cell transplant patients, it suggests a potential market opportunity in Europe alone approaching 200,000 patients. Mucormycosis is considerably rarer although the population at risk is growing, suggesting a similar at risk population in the US although the actual number of cases is small (circa 1000). The figure in Europe for deaths from mucormycosis is higher at approximately 3,000. In our forecasts therefore we assume there are circa 200,000 patients in the combined IA and mucormycosis markets in the US and Europe. Ultimately, Cresemba is available on a much broader basis and we have endeavoured to capture this opportunity as well (although at a lower effective price).

Looking to the commercial potential, we have assumed that Cresemba is used for 47 days, which represented the mean treatment duration in the Phase 3 pivotal IA study (as per the prescribing label). We have also assumed that the IV formulation (one vial) is used for eight days, with the oral capsule the remainder. We have used a price of $180/day for the oral capsules and $319 for IV administration. Using these figures suggests a price per course of therapy of c$10000. We assume a similar price in Europe, in line with typical antifungal pricing. Looking to the future there remains little on the horizon to challenge Cresemba’s position although we note the progression of the novel agent fosmanogepix into Phase 2 evaluation in mid 2020. The importance of novel antifungals with a new mechanism of action has rewarded fosmanogepix with Fast Track and Orphan designations for seven separate indications.

Forestalling a post-antibiotic era

We approach a post-antibiotic era, with the emergence of multi drug-resistant (MDR) bacteria becoming a growing threat to public health. Consequently, there have been several initiatives put in place, often government directed, to encourage the development of novel antibiotics and to minimize the risk of increasing resistance. These include the UK's Review on Antimicrobial Resistance, the WHO's Review on Antimicrobial Resistance (Global report on Surveillance 2014) and the US CDC's Antibiotic Resistance Solutions Initiative.

These initiatives are important, given the apparent reticence of the pharmaceutical industry to re-engage in antibiotic development. This reluctance has been driven by the concern that returns on antibiotic research and development are poor. There is a fear that last resort medications would only be used in the most life-threatening situations due to the acute nature of disease and to minimize the risk of resistance emerging.

Unfortunately, the pipeline for truly new antibiotics with novel scaffolds is relatively bare. In the interim, the industry has been focussed on the development of antibiotics with an extended spectrum to include resistant bacteria. Today, many of the newer antibiotics are broad spectrum with new generations from a wide range of existing antibiotic classes such as the anthracyclines (omadacycline), pluromutilins (lefamulin), or indeed the cephalosporins (such as Basilea's ceftobiprole). Many of these are targeting Gram-positive infections such as MRSA within the ESKAPE pathogen group. Thankfully, development of analogues can be relatively rapid, allowing expeditious progress.

There is growing recognition that resistance is a natural consequence of bacterial evolution, and initiatives are required to reduce the risk of resistance developing. These include:

1. Ensuring no inappropriate use of antibiotic in food-producing animals.

2. Reducing overuse in humans by targeting historically high levels of antibiotic prescribing in primary care; particularly for respiratory tract infections which are self-limiting and responsible for 60% of antibiotic prescribing and, 3. Encouraging the use of narrow spectrum antibiotics.

Much of the focus has been on the development of targeted narrow-spectrum antibiotics, particularly those treating problematic Gram-negative bacteria. However, despite these efforts, we are still some way short of delivering the number of effective antibiotics required to provide a sustainable defence against growing antimicrobial resistance. At the same time, we believe that Gram-positive infections (such as MRSA) remain a significant issue for those undergoing surgical procedures and constitute a major global public health issue.

Fifth-generation cephalosporins fulfil a gap in the market

The development of narrow spectrum antibiotics is an important objective in efforts to improve antibiotic stewardship and reduce the risk of resistance developing. However, there remains a need for antibiotics which possess broad-spectrum activity as part of empiric therapy against many of the important Gram-positive and Gram-negative pathogens. This is particularly evident given the emerging resistance to last resort vancomycin at least as far as Gram-positive infections are concerned. It is important to note that while there are other Gram-positive antibiotics available, including relatively newer classes such as the oxazolidinone Zyvox (linezolid) and the lipopeptide Cubicin (daptomycin), these harbour significant limitations. For example, linezolid is bacteriostatic with minimal Gram-negative coverage. While daptomycin may offer additional benefits (bactericidal and activity on biofilms), it has a minimal impact on Gram-negative infections, and also poor pulmonary penetration.

Further competition is afoot from newer antibiotics in development (or recently approved) such as Baxdela (delafloxacin), Nuzyra (omadacycline) and Xenleta (lefamulin), amongst others, in the treatment of complicated skin infections (ABSSSI), complicated urinary tract infections (cUTIs) and ultimately HAP/VAP. With the exception perhaps of lefamulin (retapamulin available topically for impetigo since 2006) these are all analogues of existing classes, and along with ceftobiprole offer the potential of expanding the physicians' armamentarium with new agents which have activity against bacteria resistant to similar antibiotics from the same class. For omadacycline, unlike the fifth generation cephalosporins, there is the additional prospect of an oral version to complement the intravenous formulation. This should offer patients the potential to continue therapy outside the hospital setting (hospital to home switch), as well as providing a treatment for community acquired bacterial infections, where resistance is a concern.

Furthermore, it is worth highlighting recent activity on the cephalosprin class with the approval of a novel agent cefiderocol (Fetroja) indicated for the treatment of cUTI as well as HAP/VAP patients harbouring susceptible Gram-negative infections. More direct competition in ABSSSI comes from another 5th generation cephalosporin, ceftaroline (Teflaro), currently indicated for ABSSSI and CABP. As with previous generations, the spectra of activity versus resistant bacteria has improved to include MRSA and extensively resistant strains such as vancomycin resistance bacteria (VRSA) and vancomycin intermediate Staphylococcus aureus. Additionally, the 5th generation cephalosporins possess activity against respiratory infections caused by Streptococcus pneumoniae (including multidrug-resistant strains), Haemophilus influenzae, and Moraxella catarrhalis. However, these cephalosporins have limited activity against most Gram-negative bacteria (e.g., Pseudomonas aeruginosa, Acinetobacter) and many anaerobic species.

Unfortunately, the path to commercialization for ceftobiprole has been tortuous. The initial US development through partner J&J in ABSSSI suffered a rejection from the FDA following less than acceptable scrutiny of clinical trial sites and issues over data integrity. This was a significant setback for Basilea and J&J given the completion of positive Phase 3 studies in ABSSSI. The fallout from lack of oversight also led to failure to gain full approval in the EU for ABSSSI, while sales of Zevtera in Switzerland were discontinued in 2010. As a means of compensation, Basilea was awarded $130m in damages from J&J by an arbitral tribunal, which included lost milestones, damages and interest. J&J was found to be in breach of its license agreement.

In testament to the determination of Basilea's management to secure approval for its broad spectrum cephalosporin, it continues to interact with the FDA, securing Special Protocol Assessment (SPA) in April 2017. Importantly, the company has secured financial help from BARDA providing $20m initially plus another $54.8m provided with up to $130m in total available. The clinical programme in the US is targeting the major unmet need of S. aureus bacteraemia (SAB) as well as acute bacterial skin structure infections (ABSSSI). S. aureus is a member of the ESKAPE group of particularly concerning bacterial pathogens. It is an important pathogen, being associated with a wide range of infections including those affecting the skin, bones and joints as well as the leading causative agent of bacteraemia. Ceftobiprole provides coverage of both susceptible (MSSA), and resistant (MRSA) strains of S. aureus. Of the two indications sought by Basilea for ceftobiprole in the US (SAB & ABSSSI), it is the SAB indication where we believe ceftobiprole has the potential to address an unmet medical need and where competition is less intense.

According to the CDC, 80% of MRSA bacteraemia events originate in the community, and while there has been significant progress in reducing hospital onset MRSA bacteraemia, the rate of decline has slowed since 2012. Also note that while hospital acquired MRSA bloodstream infections have declined, the same cannot be said of community associated infections.

The prevalence of SAB varies geographically with developing countries faring significantly worse than their first-world counterparts. In Europe, Southern countries fare worse than those in the North with 7 out of the 29 EU countries reporting that MRSA is found in 25% of S. aureus infections. In the key US market for ceftobiprole, the annual incidence of SAB is 38.2 – 42.7 per 100,000 person years compared to between 10-30 per 100,000 years in the developed world. This suggests a total SAB population of between 125,000 and 140,000.

The predominant bacteria associated with bacteraemia include E. Coli, S. aureus, S. pneumoniae and coagulase negative staphylococci. The bacteraemia indication is important given its high and increasing frequency, with S. aureus a leading cause of bloodstream infections. Bacteraemia associated with S. aureus generally results in poor outcomes, with complications arising such as infective carditis, septic (infectious) arthritis and osteomyelitis. Infective carditis, for example, involves infection of the heart surface (which can involve the heart valves), leading to heart failure and abscesses. Death is the usual outcome if patients do not receive adequate antibiotic therapy. Bacteraemia is associated with mortality rates of 20-30%. This rate has improved only modestly in the recent past despite efforts to better manage patients suffering from bacteraemia. Over 40% of S. aureus bloodstream infections in the US are caused by MRSA. Infection with MRSA is associated with significantly worse patient outcomes, justifying the development of antibiotics such as ceftobiprole. The US is the target market for Basilea, and ceftobiprole with its extended spectrum and potent activity against MRSA, has high commercial appeal.

Despite the approvals secured by vancomycin and daptomycin for bacteraemia, we believe that the availability of an antibiotic with a different mechanism of action would be advantageous for treatment. Indeed, we note that the use of beta-lactam based antibiotics is often perceived to be standard of care in the treatment of bacteraemia with higher rates of mortality observed in patients treated with vancomycin than beta-lactams. Vancomycin is usually the first-line therapy of choice for MRSA bacteraemia, although much of this has been driven by physician experience and cost while as noted above, the risk of daptomycin resistance is particularly worrisome. Moreover, while resistance may be the principal concern, there are other issues to consider. Volume of distribution is poor, and while bactericidal, the activity of vancomycin is slow.

Additionally, renal toxicity is an issue (particularly in combination with aminoglycosides) and administration problematic. Potentially, ceftobiprole offers an improved coverage of Gram-negative bacteria and lung penetration compared to the lipopeptides.

Ceftobiprole is currently being evaluated in the SAB indication in the Phase 3 ERADICATE trial. Submission of an NDA in the US requires a positive readout from both the TARGET and ERADICATE studies. 390 patients will be recruited into ERADICATE, where ceftobiprole is being compared to daptomycin with the option to add aztreonam to daptomycin in order to provide coverage for Gram-negative pathogens if needed in a non-inferiority design, with a non-inferiority margin of 15%. The primary endpoint is evaluating overall success at post-treatment evaluation (day 70 +/-5 days). Secondary endpoints include all-cause mortality and microbiological eradication. As we move through enrolment, Basilea has sought to improve the positioning of ceftobiprole by extending the maximum treatment duration from four to six weeks. This extension allows ERADICATE to capture patients with more severe infections such as osteomyelitis and epidural/cerebral abscesses.

As we await the outcome of ERADICATE, it is important to note that the potential of ceftobiprole in the treatment of SAB is supported by preclinical data. The data show rapid clearance of heart valve bacterial infections in models of aortic valve endocarditis and superior efficacy over vancomycin, linezolid and daptomycin. Also, Basilea previously generated positive data from patients with bacteraemia in the four completed Phase 3 trials in ABSSSI, HAP/VAP and CAP. Here, although admittedly in a post-hoc analysis 51 patients of the 3031 patients enrolled were found to have S. aureus bacteraemia. The conclusion was that ceftobiprole is associated with a similar clinical response to the comparators used (vancomycin, vancomycin/ceftazidime, and linezolid/ceftazidime) with ceftobiprole treated patients benefiting from a trend towards lower 30d all-cause mortality.

Source: Company data

While there is more uncertainty associated with the outcome of ERADICATE when compared to the positive TARGET result, we believe that the probability of success in SAB is good. Consequently, we have employed a probability adjustment of 65% with our expectation that ceftobiprole could achieve a peak 20% penetration of the US bacteraemia market. Ultimately, if successful, we believe that this could be an un-risked peak sales opportunity of $250m. Additionally, we expect the addition of a SAB indication should raise the profile of ceftobiprole with clinicians generally, as a differentiated 5th generation cephalosporin antibiotic. A better profile could have an impact on its use in other infections where MRSA is the prime suspect.

The successful development of ceftobiprole in ABSSSI has effectively completed the regulatory journey started with its initial development with J&J. However, over the intervening years, the competitive environment has changed markedly with, for example, the fifth-generation cephalosporin antibiotic ceftaroline (branded as Teflaro), already approved in the ABSSSI indication in the US (in 2010). Additionally, the ABSSSI indication has been the initial target for many of the recent Gram-positive antibiotics suggesting a more limited market opportunity in this indication, certainly when compared to the initial timelines of a 2009 expected market introduction.

Nevertheless, the ABSSSI indication remains an important element of the regulatory filing process in the US. It was therefore pleasing to see the positive outcome of the Phase 3 TARGET study, with ceftobiprole confirming its activity with a >90% response at both the primary and secondary endpoints while meeting the non-inferiority requirements (10% NI margin).

Source: Company data

Importantly, from a commercial perspective, Basilea has secured QIDP (Qualified Infectious Disease Product) status (for SAB, ABSSSI and CAP), which provides an additional five years of exclusivity. Along with an initial five years as part of Hatch Waxman, provides ten years without generic competition in this key market. Given the time that has elapsed since the initial development of ceftobiprole, the availability of this extended period of exclusivity has been crucial. Ultimately, we expect that Basilea will be able to secure a partner for ceftobiprole, and this will likely occur following the successful conclusion of the Phase 3 programme.

We expect that ceftobiprole should be able to secure a higher price in the US than in Europe. Looking at the prescribing label for daptomycin in bacteraemia, the recommendation is for therapy to last for between two and six weeks, hence the importance of the recent trial extension for ceftobiprole.

These parameters suggest a price of between $5,600 and $11,200. In our forecasts, we have conservatively assumed that the majority of patients are closer to the two-week therapy and so have used $6000 as the cost of a typical treatment.

For the ABSSSI indication, we believe that pricing will be similar to that achieved by other fifth-generation cephalosporins. ABSSSI will have a much shorter course of treatment than SAB, and we have therefore assumed a price of $3000 per treatment. We expect ceftobiprole to reach the market in 2023, taking into account any further COVID-19 related delays in recruitment, as well as the extended duration protocol amendment. Although the ABSSSI indication has been de-risked, we have employed the same probability of success given that a positive result from both studies is required for approval. We assume that ceftobiprole is able to secure a 3-4% share of the large ABSSSI market at peak, recognizing that much will depend on the capabilities of the partner selected. Nevertheless, such is the size of the ABSSSI indication in the US, even this modest market penetration suggests an un-risked peak sales market potential of $175m.

Zevtera labelling in Europe could change

While integrity issues may have scuppered the commercial outlook for ceftobiprole in ABSSSI Basilea also evaluated its potential in the nosocomial pneumonia indication. A positive outcome positioned ceftobiprole as the only antibiotic therapy approved in monotherapy. This reduced the need for combination therapies to provide adequate coverage of the two principal causative agents S. aureus (including MRSA) and P. aeruginosa.

Although ceftobiprole was found to be broadly similar to comparator ceftazidime (with or without linezolid) in the hospital-acquired pneumonia (HAP) and community-acquired pneumonia (CAP) indications, it wasn't non-inferior to the comparator in the subgroup of patients with ventilator-associated pneumonia (VAP). While it is entirely possible that the ceftobiprole result was a consequence of the small sample size and/or suboptimal concentrations at the site of infection, the result is that ceftobiprole has been approved in Europe for the treatment of CAP and HAP but excluding VAP.

Despite this limitation, the market potential for ceftobiprole should still be meaningful. CAP is particularly worrisome for the elderly (>50% of deaths occur in those aged over 84) and is a leading cause of hospitalizations. Approximately 22-42% of patients who are diagnosed with CAP are admitted to hospital, and up to 10% of these managed in the ICU. If admitted to hospital, the mortality rate is between 5% and 14% rising to 40% in those admitted to the ICU. Paradoxically, while the majority of CAP is caused by S. pneumoniae and S. aureus CAP identified in <2% of patients (<1% with MRSA), about one-third of hospitalized CAP patients receive anti-MRSA antibiotics.

HAP is responsible for 25% of infections in the ICU and has significant associated costs (overall circa $100K per patient). Early-onset HAP has generally been associated with the same pathogens as CAP. At the same time, late onset HAP is more reflective of the local bacterial ecology in the ICU (predominantly P. aeruginosa and Staph aureus). Consequently, late-onset HAP has a greater proportion of multidrug resistant organisms. The addition of the HAP indication should provide ceftobiprole with a stronger market position in Europe than its direct competitor ceftaroline (branded as Zinforo in Europe) which although approved for ABSSSI is also approved in CAP but not HAP.

The opportunity in nosocomial pneumonia is large, and ceftobiprole offers a broad spectrum coverage which potentially simplifies empiric therapy, particularly where MRSA is suspected. However, financial performance to date has been muted. We suspect that the lack of a specific VAP indication is unhelpful with respect to market perception. Within the nosocomial pneumonia opportunity, VAP is generally seen as the more urgent medical need where the presence of multidrug resistant bacteria is associated with a significantly worse outcome, and where 50% of antibiotic usage in the ICU lies.

With clinical trials evaluating ceftobiprole for the treatment of ABSSSI and SAB indications in the US, we suspect that the possibility of expanding the label in Europe and other territories where ceftobiprole is available for the CAP/HAP (excluding VAP) indication.

Although Basilea began the commercialization of Zevtera with a contract sales force from Quintiles, the decision ultimately has been to partner in relevant geographies. This has proven to be a highly productive effort with established license and distribution agreements for ceftobiprole forged with multiple partners covering more than 80 countries. These include Correvio for Europe (excl. Nordics), Unimedic for the Nordics, Hikma for the MENA region, Grupo Biotoscana for Latin America, Avir for Canada and Gosun for China.

Risks

Basilea’s currently marketed products are out-licensed to third parties, which suggests that the company has little influence with the end customer. That said, in the case of the anti-fungal Cresemba, Astellas and Pfizer bring market leading anti-fungal franchises with good execution to date.

While the antibiotic Zevtera is already marketed outside of the USA for the treatment of CAP and HAP (excluding VAP), we see the more significant market opportunity in the Staph aureus bacteraemia indication. The data from the bacteraemia patients in the four completed Phase III trials are supportive of this approach, however, there is uncertainty associated with this difficult to treat patient population which is reflected in the probability adjustment we have employed. At the same time, approval of ceftobiprole in the US requires a positive outcome for both the (lower risk) ABSSSI indication (already achieved) as well as the bacteraemia indication.

Our forecasts suggest that Basilea will self-commercialise ceftobiprole in the US and have burdened the income statement with the costs associated with such an eventuality. Basilea on the other hand has communicated that it will seek to attract a commercial partner for Zevtera in the US and while there is a partnering risk associated with this strategy, we believe that Basilea has a successful track record in this regard.

The un-partnered oncology programmes are still relatively early stage apart from the recently in-licensed derazantinib. While, there is a risk that the oncology pipeline may be associated with delays and potentially negative and/or inconclusive clinical trial results, the positive interim analysis in iCCA for derazantinib largely de-risks this programme in this indication. This is a highly competitive field but we note Basilea’s endeavours to differentiate derazantinib and we would highlight the combination with the checkpoint inhibitors in urothelial cancer as a starting point.

Our financial forecasts suggest Basilea will experience several years of losses. With our expectation of a 2023 launch for ceftobiprole, our forecasts do not incorporate the expected upfront payment that the company would receive from a commercial partnership. Consequently, we are forecasting a negative cash position for several years but recognise that there are many puts and takes to our forecasts. Additionally, we have effectively taxed the company on its first year of profits despite the observation that there are significant tax losses which will significantly reduce the tax burden in the near term.

Summary and Financial Model

Since its IPO in 2004, Basilea has sought to finance its R&D through the sale of equity, debt and through attracting appropriate commercial partners on highly lucrative terms. After a withdrawn NASDAQ IPO in 2015, Basilea raised CHF200m through a convertible bond issue, due in 2022 with a 2.75% coupon paid semi-annually in arrears. The issue allowed management to fund the Phase 3 development of ceftobiprole in the US, and progress the oncology pipeline. More recently, Basilea has raised CHF97m and retired circa 25% of the 2022 bond, which combined with selling the existing headquarters facility has significantly strengthened the company's cash resources.

The company has been highly successful in non-dilutive funding, either selling assets in their entirety (Toctino for £146m to Stiefel in 2012), or selling promotional/marketing rights to pharmaceutical partners. We view Cresemba, in particular, as a highly valuable pipeline asset at Basilea with the Astellas agreement delivering CHF75m in upfront payments in 2010, and adding Pfizer in 2017 for an additional CHF 70m (+CHF 3m on extending territories). Other markets such as Japan have been licensed to Asahi Kasei (CHF 7m upfront). The agreement with BARDA for ceftobiprole Phase 3 development in the US amounts to $130m, and represents an additional and important source of non-dilutive funding. Our financial model does not include the expected upfront payment should Basilea attract a suitable partner for ceftobiprole in the US.

Our financial model incorporates Cresemba royalties and sales to its distribution partners, as well as Zevtera sales through Correvio in Europe. Cresemba may be impacted in the short term by coronavirus dislocation, but global demand remains strong and we expect demand will return for antifungals with an advantageous profile like Cresemba. Our forecasts include risk-adjusted sales of ceftobiprole for both the ABSSSI in the US and bacteraemia indications. Despite the positive result of the TARGET study, and encouraging post hoc analysis of the bacteraemia trials, it is a more difficult patient population, and we look forward to the results of ERADICATE in Q1 2022 to finally de-risk our sales expectations. Basilea has been highly successful in attracting suitable partners for its programmes and has negotiated attractive and lucrative agreements. For ceftobiprole, with BARDA effectively funding a large part (approximately 70%) of the clinical programme, it would make sense for the company to wait until the end of the Phase 3 programme before securing a partner. At this stage given the uncertainty surrounding a potential partnership agreement we have incorporated US sales fully to Basilea, recognising that in all likelihood, the company will receive royalties as well as a significant upfront payment. Clearly, we will adjust our assumptions post a partnering event.

The oncology pipeline investment has proven to be propitious. The FGFR class, in general, has proven successful in appropriate difficult to treat cancers. Basilea's endeavours in the US are hopefully de-risked by competing products approved on an accelerated basis. Our take is that competitor products are different based on receptor targeting, and we note that in particular derazantinib has an additional differentiating feature (CSF1R) which should enable it to find its niche, likely in combination with checkpoint inhibitors like Tecentriq. Data later this year, in fast to market biliary cancer (FIDES-01), should help de-risk this asset further in monotherapy. However, with the competitive noise elsewhere in this therapeutic class, it is the interim result of FIDES-02 in 2021, evaluating the combination (with Tecentriq) in urothelial cancer, which will drive appreciation of derazantinib's potential. Nevertheless, we do not see this as a truly binary proposition. There is a reasonable probability that even if the combination fails, the monotherapy arm should deliver a positive result (based on Balversa approval).

Basilea is in a very fortunate position, possessing a differentiated participant in a fast-growing class with potentially very broad applicability. However, with limited resources, Basilea has chosen to follow the science and fund derazantinib clinical evaluation selectively. FIDES-03 in gastric cancer is an excellent example, with preclinical data used to identify the most relevant indication to pursue derazantinib in combination with Tecentriq. Ultimately, we would expect Basilea, potentially along with a strategic partner, to continue its evaluation of derazantinib in other FGFR driven tumours, but clearly much will depend on the data. We have incorporated risk-adjusted sales only for the iCCA indication but not for other potential indications or combinations, suggesting significant upside to our current forecasts. Again, we will adjust our assumptions post data and any partnering event.

Our initial view of lisavanbulin and glioblastoma was tempered by the challenge of effectively treating an extremely heterogeneous disease. However, the identification of the biomarker EB1 potentially provides a solution allowing Basilea to enrich lisavanbulin clinical trials with patients who should benefit from treatment. While we are greatly encouraged by the "profound" benefit experienced by a subset of patients receiving lisavanbulin, data remain sparse. So lisavanbulin remains outside of our financial model and valuation for now. However, considering the dearth of new effective agents for glioblastoma and the resistance profile of lisavanbulin, we would like to think that the regulatory hurdle for an effective agent with an acceptable safety profile should be relatively low. Here we acknowledge the willingness of the FDA to provide approval on a conditional basis where appropriate.

Our model suggests management will continue to fund R&D carefully while recognizing the highly competitive nature of the FGFR class. The clinical profile is becoming clearer, and there are many data points ahead which will help direct Basilea's investment in derazantinib. Consequently, we are forecasting stable R&D funding for the foreseeable future, with R&D spend only set to rise in 2024/5 as growing revenues allow.

However, there are many puts and takes to our forecasts. The company has the potential to reduce spending, particularly in R&D as the costs of the Phase 3 ceftobiprole programme dissipate. There is also uncertainty over additional in-licensing efforts and the need to increase spending to support these as yet unidentified programmes. On the plus side, we have no insight into the size and timing of the anticipated upfront payment associated with a ceftobiprole agreement.

Additionally, we have taxed the company on its first year of profits despite the existence of significant net operating losses carried forward. These losses should reduce the tax burden in the near term. Furthermore, there is the potential for the company to re-finance debt or raise cash through the sale of equity if desired.

With this in mind, we note the additional convertible debt raised by the company in June this year. With $200m of convertible initially due in 2022, this has been something of an overhang for the company, particularly as it entered a net debt position. In July, Basilea retired circa 25% of the outstanding 2022 bonds, while at the same time issuing new convertible debt boosting the cash position. We expect Basilea to take additional steps to reduce the overhang associated with the remaining 2022 bond over the next two years.

Valuation